The price of Bitcoin continues to face downward pressure, trading near $103,000, even as several potential positive influences emerge. Recent market dynamics are causing concern among traders and analysts, leading to speculation about the future trajectory of this leading cryptocurrency.

Despite the end of the U.S. government shutdown, which lasted 43 days and was signed into law by President Donald Trump, Bitcoin has not experienced the expected positive momentum. The cryptocurrency market remains range-bound without significant macroeconomic catalysts, according to experts.

Market data indicates that Bitcoin exchange-traded funds (ETFs) in the United States are experiencing notable outflows. In just the last ten days, only three inflows have been recorded, while ETFs sold off approximately $278.1 million worth of Bitcoin on Wednesday alone. Specifically, BlackRock”s IBIT suffered a $36.9 million outflow, while Fidelity”s FBTC, Ark 21Shares” ARKB, and GBTC recorded outflows of $132.9 million, $85.2 million, and $23.1 million, respectively.

The selling trend appears to follow recently released ADP jobs data, which revealed a weakening labor market in the U.S. Private companies reportedly cut an average of 11,250 jobs weekly throughout October. This economic backdrop has prompted long-term holders and market whales to reassess their positions on Bitcoin, leading to a sense of uncertainty about price peaks that were anticipated for September and October.

According to analyst Scott Melker, historical trends indicate that Bitcoin typically reaches its peak 12 to 18 months after a halving event, with significant price movements occurring around 1,060 to 1,070 days post-cycles. Currently, Bitcoin is approximately 1,080 days removed from its last major cycle low, further complicating the outlook.

Experts at 10x Research emphasize that Bitcoin is plunging to levels that have taken many analysts by surprise this year. The once-reliable dip-buying support from market participants has diminished, indicating a shift in sentiment. Markus Thielen, head of 10x Research, pointed out a critical transformation in market flows and long-term holder behavior that is reshaping the market.

The decline in trading volumes also paints a grim picture, with crypto trading volumes decreasing by 50% over the past year, from $352 billion to $178 billion. Matrixport has indicated that the market may be entering a mini-bear phase, as suggested by various on-chain indicators. Despite the presence of potential catalysts, they are insufficient to drive Bitcoin prices higher in a landscape characterized by low liquidity.

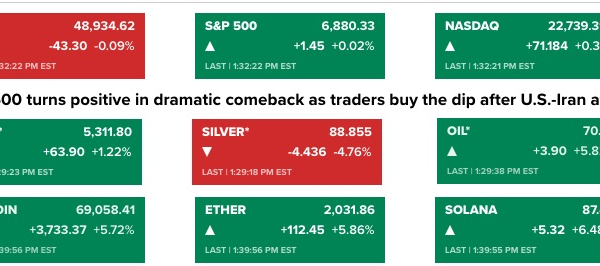

Looking ahead, QCP Capital anticipates choppy trading conditions for Bitcoin and the broader crypto market throughout the fourth quarter. Economic indicators such as the ADP and NFIB data suggest a softening labor market, compounded by ongoing tariff tensions and credit volatility. Nevertheless, there are hopes that potential Federal Reserve interest rate cuts and solid corporate earnings could provide some support for Bitcoin and other risk assets, extending into 2026.

Technical analysis from GreeksLive indicates a rise in Bitcoin open interest and trading volume within the options market, yet signs of market uncertainty loom large. Analysts are observing bearish formations, including falling wedge, head-and-shoulder, and bear flag patterns. Crypto analyst Ali Martinez has forecasted a potential decline to $83,000 based on a head-and-shoulders pattern, suggesting a possible rebound to $112,000 before further downward movement.

At the time of writing, Bitcoin is trading near $103,000, having rebounded about 1% in the last 24 hours but is still down more than 20% from its all-time high. The 24-hour trading range has seen lows of $100,836 and highs of $105,297. Data from Coinglass shows a 2% drop in total Bitcoin futures open interest over the past day, reflecting ongoing sell-offs in the market.