In a surprising twist amidst a turbulent cryptocurrency market, XRP and Solana have emerged as notable exceptions, attracting substantial investment inflows despite the prevailing negative sentiment. As Bitcoin and Ethereum ETFs experience significant outflows, the ETFs associated with XRP and Solana have collectively drawn nearly $900 million, revitalizing discussions about their future price trajectories.

The XRP ETF alone recorded an impressive $410 million in inflows, while Solana”s ETF garnered close to $500 million. This influx of capital is prompting traders and analysts to reassess their price predictions for XRP, even as the broader market faces challenges. Notably, the new XRP ETF from Bitwise witnessed an immediate $105 million influx on its launch day, complemented by an additional $13 million from Canary“s XRPC product.

This resilient performance of XRP and Solana ETFs stands out against a backdrop of declining prices for other cryptocurrencies, suggesting a growing institutional interest in these assets. This trend is indicative of a potential shift in market dynamics, where specific tokens are viewed as more stable investments during uncertain times.

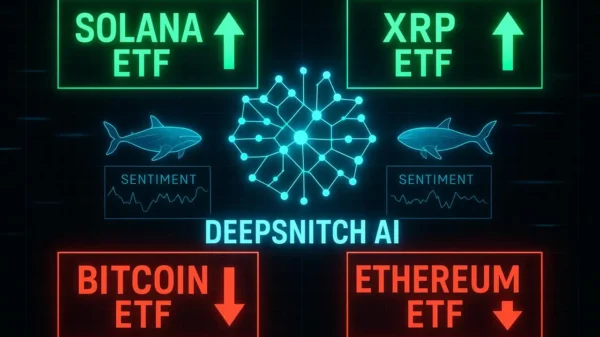

Amidst these developments, DeepSnitch AI has emerged as a standout performer, reporting a remarkable 60% increase in its presale, which has raised $562,000. This project is gaining traction among traders due to its innovative use of artificial intelligence to provide real-time insights into market movements. The platform”s five AI agents are designed to monitor whale activities and market sentiment shifts, offering users a competitive edge in a volatile environment.

DeepSnitch AI”s unique value proposition lies not only in its advanced tracking capabilities but also in its emphasis on community engagement and marketing. The project”s playful branding, including a memorable mascot and a significant marketing budget, positions it as a potential viral success in the crypto space.

As XRP ETFs continue to attract money without experiencing any outflows, analysts are optimistic about their long-term outlook. Current projections suggest a potential target of around $2.85 for XRP, with some traders speculating on a rise towards $4 by early 2026, contingent on sustained ETF demand.

Similarly, Solana”s ETF inflows are noteworthy, bringing in nearly $500 million, even as the SOL price has dipped over 33% in the past month. This unusual trend indicates that investors remain confident in Solana”s future, believing the recent downturn may be temporary rather than a reflection of fundamental weaknesses.

The strong performance of XRP and Solana ETFs, combined with the innovative approach of DeepSnitch AI, reflects a shifting landscape in the cryptocurrency market. As traders adapt to changing conditions, these assets are becoming focal points for those looking to capitalize on emerging trends and insights.

In conclusion, the current inflows into XRP and Solana ETFs present a compelling narrative amid a generally bearish market. As traders and investors navigate the complexities of the crypto landscape, tools like DeepSnitch AI are proving invaluable for making informed decisions in real-time.