The cryptocurrency market is currently in a severe downturn, with Ethereum experiencing a significant drop below $2,700. On November 21, 2025, the price of Ethereum fell by more than 10%, reaching lows of approximately $2,600, a level not seen since July. This decline coincided with a broader market correction, as Bitcoin also hit new multi-month lows, further exacerbating investor concerns.

The drop in Ethereum”s value was primarily driven by a wave of liquidations, amounting to over $400 million within a 24-hour period. The majority of these liquidations were long positions, with around $374 million lost. Overall, the liquidation across the cryptocurrency market totaled nearly $2 billion, with Bitcoin contributing significantly to this figure, as over $940 million in positions were liquidated.

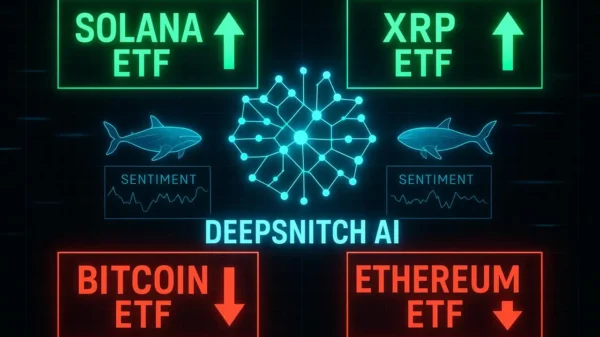

In addition to the drop in prices, there has been a noticeable trend of outflows from cryptocurrency investment products. Recent reports indicate that both spot Bitcoin and Ethereum ETFs experienced consecutive net outflows, with Bitcoin spot ETFs showing a loss of $903 million and Ethereum ETFs seeing outflows of $262 million on November 20. Interestingly, while Bitcoin and Ethereum faced capital losses, Solana spot ETFs recorded inflows exceeding $23.6 million.

The loss of the critical support level at $2,800 and the decline to around $2,600 suggests that further weakness may be on the horizon unless bulls can initiate a rapid recovery. Analyst insights indicate that the next key support level to monitor for Ethereum could be $2,500, highlighting the precarious state of the market.

In contrast to the prevailing bearish sentiment, Bitmine, a major player in the Ethereum treasury space, has taken advantage of the price drop to increase its holdings. The Nasdaq-listed company revealed it purchased an additional 17,242 ETH for approximately $44.46 million on November 20, raising its total holdings to about 3.62 million ETH. This strategic move by Bitmine underscores a divergence between market sentiment and institutional buying tactics.

Despite the current losses that have left Bitmine with substantial paper losses—reportedly over $1,000 per ETH, translating to around $3.7 billion—this acquisition reflects a vote of confidence in Ethereum”s potential in the long term. However, the challenges faced by treasury companies like Bitmine in attracting new retail investors during this market correction cannot be overlooked, especially as existing shareholders deal with significant unrealized losses.

The ongoing volatility in the cryptocurrency market continues to test investor resilience, with analysts closely monitoring the situation for signs of recovery. As Ethereum and Bitcoin navigate this difficult landscape, market participants remain vigilant for potential rebounds or further declines.