The cryptocurrency XRP experienced a significant decline, trading at approximately $1.98, down 7% in just 24 hours and 18% over the past week. This downturn coincided with the launch of the Bitwise XRP ETF on the New York Stock Exchange (NYSE), as the overall crypto market faced a sharp sell-off.

On the day of the ETF”s introduction, XRP fell below the crucial $2.00 mark, reflecting price levels not seen since the market correction on October 10. This unexpected drop caught many in the Ripple community off guard, who had been optimistic about the ETF”s potential to boost market sentiment.

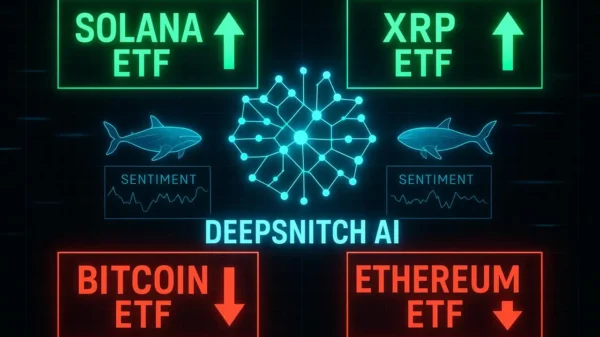

The broader market dynamics played a significant role in this volatility, particularly following Bitcoin“s decline below $86,000, which triggered over $220 million in long liquidations within an hour. This abrupt correction interrupted the bullish momentum that had been building around Ripple”s ecosystem in recent weeks.

Despite the price drop, the Bitwise XRP ETF registered a notable first-day trading volume of $22 million, highlighting robust interest in the product. According to ETF analyst James Seyffart, this performance is particularly impressive given that it followed just a week after Canary Capital”s XRPC ETF, which currently holds the record for the strongest ETF launch of the year. The ETF, which features a management fee of 0.34%, waived for the first month on the initial $500 million in assets, allows investors to gain direct exposure to spot XRP.

Additionally, on-chain analytics indicate internal market pressures contributing to XRP”s price weakness. Data from Glassnode shows a notable decline in the supply of XRP held in profit, dropping to 58.5%, the lowest since November 2024. This suggests a market heavily influenced by late-stage buyers, with approximately 41.5% of the circulating supply experiencing losses.

Whale activity has also been a factor, as reports indicate that large holders sold around 200 million XRP within 48 hours following the ETF”s launch. Such substantial liquidations are known to heighten market volatility in the short term.

The introduction of a spot XRP ETF marks a significant milestone, providing U.S. investors with regulated access to XRP through a conventional investment vehicle. This development reflects growing confidence in the XRP Ledger ecosystem, which has seen an increase in value of over 80% in the past year. However, analysts caution that substantial institutional inflows may be slow to materialize, with expectations that meaningful adoption could take until 2026 as large financial entities become comfortable with incorporating XRP into their portfolios.

Overall, the initial excitement surrounding the ETF launch has been overshadowed by market conditions, leaving XRP investors to navigate both immediate volatility and the long-term implications of increased institutional access to the Ripple ecosystem.