Digital asset treasury firms are facing significant challenges, prompting some to liquidate portions of their cryptocurrency holdings to support stock buyback initiatives. Notably, FG Nexus recently sold $32.7 million worth of Ethereum (10,922 ETH) after experiencing a staggering 94% drop in stock value over just four months.

This sale underscores a broader crisis of net asset value (NAV) among companies managing substantial cryptocurrency assets, which collectively amount to over $42.7 billion. The financial strain is evident as companies grapple with their stock prices trading below the actual value of their crypto holdings.

In October, FG Nexus initiated a $200 million share buyback program, necessitated by its stock”s decline below NAV. The firm retained approximately 40,005 ETH and $37 million in cash, while its total debt rose to $11.9 million. The share repurchase involved buying back 3.4 million shares at roughly $3.45 each, which accounted for 8% of the total shares outstanding. Management emphasized that these purchases were made at a discount to NAV, which reached $3.94 per share by mid-November.

However, executing this strategy required taking on about $10 million in debt and liquidating 21% of its ETH reserves compared to levels from September. The situation at ETHZilla mirrors this trend; the company recently announced a $40 million sale of ETH to fund stock repurchases and has since acquired 600,000 shares for nearly $12 million. This action was taken in response to persistent trading at a 30% discount to NAV.

When a digital asset treasury company”s shares trade below the value of its underlying crypto assets, management is often urged to realize this hidden value through stock buybacks. However, if cash reserves are insufficient, these firms are left with little choice but to liquidate crypto assets.

For instance, Metaplanet experienced a decline in its mNAV, dropping to 0.99 before rebounding slightly to 1.03. Their shares have suffered a 70% decrease since June, indicating ongoing sector-wide stress.

The reliance on leveraged financial structures complicates matters further. In 2025, these treasury companies amassed $42.7 billion in crypto, with $22.6 billion accumulated in the third quarter alone, driven by a rally in Bitcoin prices exceeding $126,000. However, subsequent price reversals have revealed weaknesses in capital structures heavily reliant on leverage and market access.

Digital asset treasury firms represent a mere 0.83% of the total cryptocurrency market capitalization, yet their concentrated holdings can amplify market impacts during downturns. The use of convertible notes, private investments in public equities, and perpetual preferred equity intensifies selling pressure when asset prices decline or NAV discounts widen.

As confidence wanes and capital deployment diminishes, corporate buying has stalled, with prominent firms like MicroStrategy witnessing a 60% drop in stock value amid Bitcoin volatility. Smaller treasury firms, particularly those with less liquid assets, are under immense pressure, with some facing NAV drawdowns of 40% due to concentrated investments.

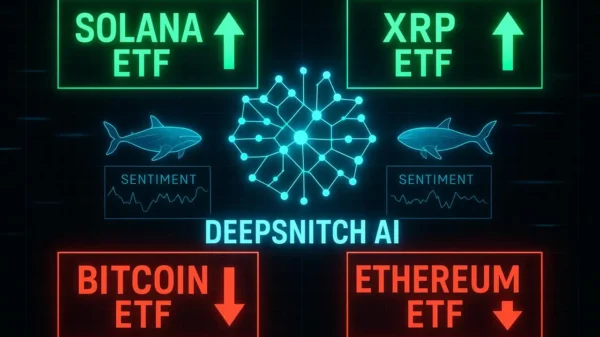

The exit of retail investors has further diminished market demand, as they liquidate positions ahead of institutional sell-offs. In November alone, ETF outflows amounted to $4 billion, coupled with reduced market-maker activity, exacerbating market volatility.

This unfolding scenario reflects a growing crisis within the digital asset treasury model, raising concerns about the resilience of these companies during prolonged market downturns. To mitigate the risk of destabilizing sell-offs, enhanced risk management and regulatory oversight may be essential.

As the market progresses, the capability of these firms to sustain their crypto holdings without further forced liquidations will play a crucial role in determining the future viability of the sector.