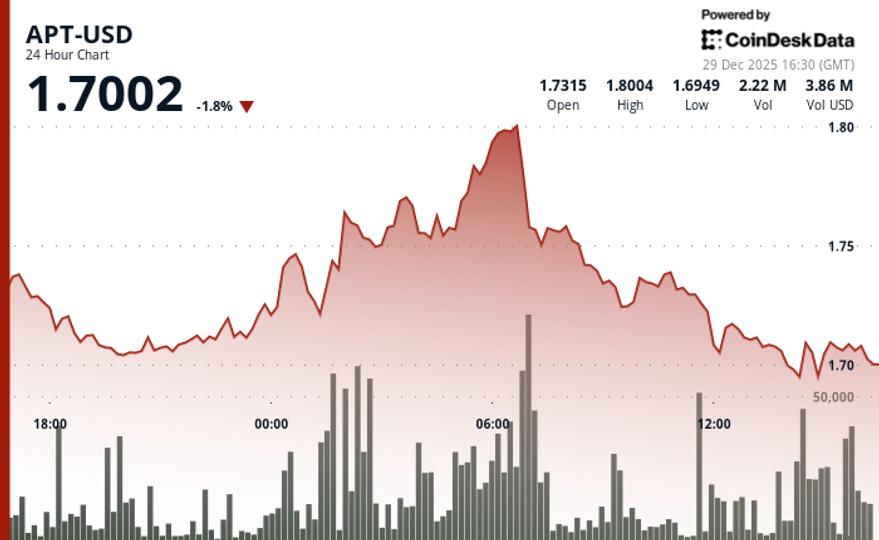

The Aptos token, known as APT, has experienced a decline of 1.7% over the past 24 hours, settling at $1.70. This downturn is occurring amid a broader market decline, as evidenced by the CoinDesk 20 index, which fell by 0.7% at the same time. The trading activity for APT has been notably low, with volumes approximately 16% below its 30-day average. This suggests a lack of strong institutional interest in driving the price higher.

Technical analysis indicates that APT is currently navigating a volatile trading range characterized by a fluctuation of $0.12, equating to 6.7% of the token”s value. Resistance has formed near the $1.78 mark, which was evident during a failed breakout attempt earlier in the day that occurred on heightened trading volume. In the absence of significant fundamental catalysts, the focus shifts to technical levels, underscoring the importance of support and resistance as the token consolidates.

Aptos remains within a defined range, supported at $1.69 and facing resistance around $1.80. This range-bound consolidation highlights the underlying market dynamics, as buyers have shown interest, preventing more severe declines. The recovery from intraday lows indicates a level of resilience in the face of downward pressure.

Key insights from the technical analysis include:

- Resistance identified between $1.78 and $1.80, where volume-driven rejections have occurred.

- Short-term resistance observed at $1.72, based on recent consolidation patterns.

- A 24-hour trading volume shortage of 16% compared to the 30-day average, reflecting weak market conviction.

- Consolidation confines APT within the $1.69 to $1.80 price boundaries.

- Potential upside targets include initial resistance at $1.72 and an extended target in the $1.78-$1.80 range.

- Downside risks are present, with support tested at $1.69 and a critical breakdown level below $1.66.

As traders and investors closely monitor these key levels, the future trajectory of APT will depend significantly on market sentiment and any emerging catalysts that may influence trading activity.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk”s full AI Policy.