The immediate future of Bitcoin is closely tied to its ability to breach the critical $91,000 resistance level. As we approach the end of the year, the cryptocurrency market is witnessing typical seasonal behaviors, including diminished trading volumes and cautious investor sentiment.

Recent outflows from spot Bitcoin exchange-traded funds (ETFs) indicate a short-term retreat by some investors, coinciding with year-end portfolio adjustments. However, despite these outflows, institutional demand for Bitcoin remains evident, suggesting a split outlook where caution prevails in the short term while medium-term support is bolstered by long-term investors.

Looking ahead to 2026, Bitcoin“s price movements will likely be influenced by three primary factors: global liquidity, regulatory clarity, and enhanced institutional engagement through ETFs. The interplay of these elements is expected to shape the cryptocurrency”s market performance significantly.

Analysis of ETF flows reveals that the recent end-of-year outflows are tactical, as institutions strategically manage their portfolios. This behavior is common as investors trim risks in anticipation of the new year, often leading to increased volatility in price movements.

Additionally, movements by cryptocurrency whales can signal potential market shifts. Large transfers to exchanges can suggest either risk management strategies or impending sell-offs. In low-volume conditions typical of the year-end, such movements can heighten price fluctuations.

The macroeconomic landscape also plays a critical role in determining Bitcoin”s path. With inflation nearing target levels, potential interest rate cuts by the Federal Reserve could stimulate demand for risk assets like Bitcoin. Conversely, renewed inflationary pressures or geopolitical tensions could result in defensive market behaviors.

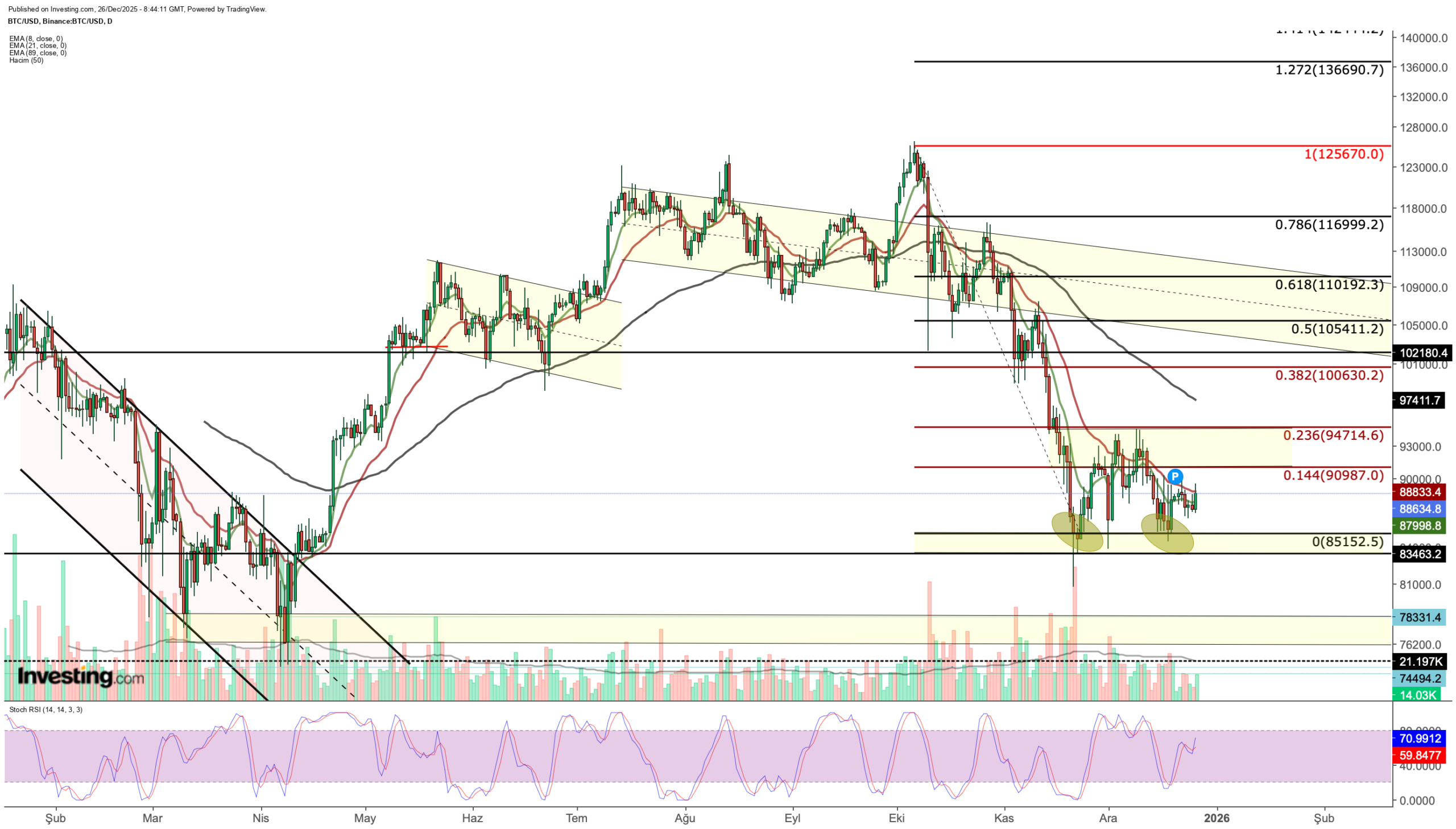

From a technical analysis perspective, Bitcoin is currently in a consolidation phase following the sell-off in October and November. The $85,000 level has emerged as a pivotal support point, while resistance is noted around $91,000 and further at $94,700. A decisive break above these resistance levels could indicate a shift towards a more bullish trend, with potential targets extending to $100,600, $105,400, and $110,000.

In summary, while the short-term outlook for Bitcoin may appear cautious, the underlying institutional demand and potential macroeconomic shifts could provide a foundation for future growth. Investors should closely monitor key resistance levels and broader market dynamics as we move into the new year.