As we approach the end of December, Bitcoin finds itself at a crossroads, with its near-term trajectory heavily reliant on a successful breakout above the $91,000 resistance level. Recent market behavior has shown typical year-end patterns, characterized by decreased trading volumes and a cautious investment climate.

In recent weeks, we have witnessed noticeable outflows from spot Bitcoin ETFs, indicating that some investors are pulling back their exposure as they reassess their portfolios for year-end adjustments. This has led to a mixed sentiment in the market; while short-term conditions suggest caution, longer-term institutional accumulation appears robust, hinting at a structural demand that could support prices beyond current volatility.

The dynamics influencing Bitcoin”s price trajectory as we look towards 2026 hinge on three primary factors: global liquidity, regulatory clarity, and institutional participation through ETFs. Liquidity, shaped by the actions of the Federal Reserve, plays a pivotal role in determining risk appetite for assets like Bitcoin. Clarity in regulation surrounding ETFs and stablecoins is equally crucial, as it can facilitate easier market entry for a broader range of investors.

Analyzing ETF flows reveals a tactical short-term reaction to market conditions. The recent outflows from Bitcoin ETFs are not indicative of a long-term bearish sentiment but rather a strategic move by institutions to manage risk before year-end. Historical patterns suggest that as financial conditions ease, capital flows into risk assets like Bitcoin typically accelerate, advancing its demand.

Moreover, whale activity on the blockchain adds another layer of complexity. Large transfers, particularly to exchanges, often raise alarms about impending sell-offs. However, these movements frequently indicate risk management strategies instead of immediate liquidation intentions. During periods of low volume, such transfers can exacerbate market volatility, further complicating the technical landscape.

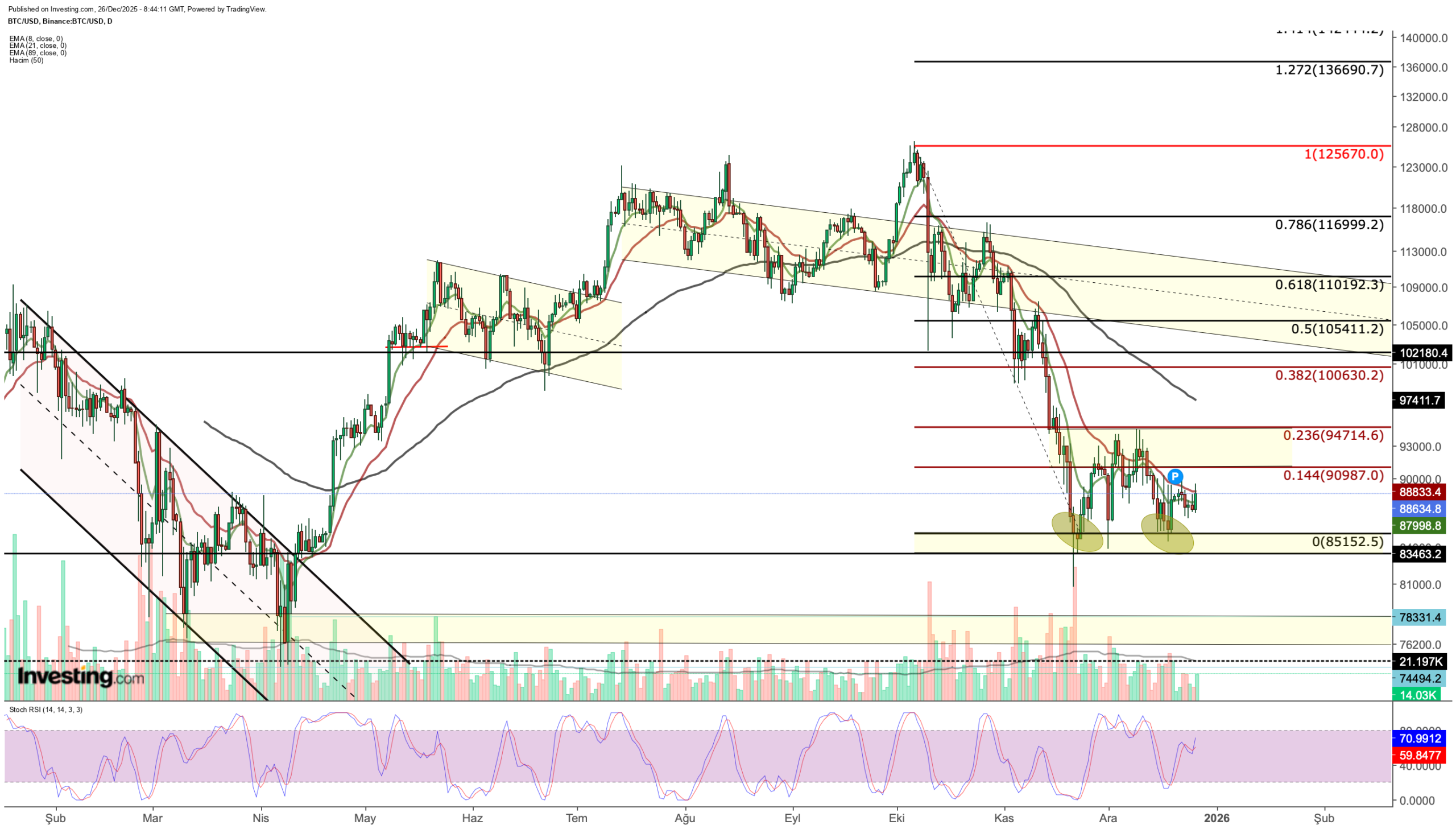

From a technical standpoint, Bitcoin is currently in a consolidation phase following the substantial sell-off witnessed in the previous months. The $85,000 mark has emerged as a crucial support level, having been tested multiple times. Should the price remain above this threshold, the consolidation may continue, but a decisive break below could lead to increased selling pressure.

On the upside, overcoming the $91,000 resistance could signal a shift in momentum, with more significant resistance levels at $94,700 and beyond. Technical indicators suggest a need for sustained price action above these levels to validate any bullish sentiment. As the Stochastic RSI shows signs of recovery from oversold conditions, the potential for a short-term rally exists, provided Bitcoin can achieve daily closes above these critical resistance zones.

In conclusion, Bitcoin”s near-term outlook is intricately tied to its ability to navigate the current market conditions and resistance levels. With institutional strategies and liquidity factors shaping the landscape, traders and investors should remain vigilant as they assess the unfolding dynamics in the cryptocurrency market.