Bitcoin continues to experience structural pressure, trading within a defined corrective phase. Recent price movements indicate a period of hesitation and compression rather than a continuation of trends, implying that the market is awaiting a significant catalyst for its next directional shift.

On the daily chart, Bitcoin adheres to a broader descending structure following a recent impulsive selloff. Currently, the price is trapped between a well-established demand range of $82K to $80K and a crucial resistance area around $95K to $96K. The consistent inability to reclaim mid-range resistance emphasizes ongoing sell-side dominance, while the formation of lower highs indicates weak bullish momentum.

Presently, Bitcoin is trading closer to the lower part of this range, where buying interest has historically defended the price. Nevertheless, the lack of pronounced bullish movement from this zone suggests that demand is largely reactive rather than driven by initiative. As long as BTC remains below the resistance level at $95K and the descending trend structure persists, the daily bias is likely to remain neutral to bearish, favoring either consolidation or a gradual continuation of downside movements.

The 4-hour chart offers a more detailed perspective on the current market dynamics. The primary cryptocurrency is consolidating within a narrow range after a lengthy selloff, creating a compression zone beneath a rising short-term wedge and overhead resistance. This price action reflects a balance between buyers and sellers rather than a phase of accumulation, as BTC has repeatedly struggled to break higher with conviction.

Recent attempts to rally have faced swift rejection, indicating that supply remains active during minor upward movements. Conversely, selling pressure has diminished near the $85K to $86K area, where short-term demand continues to absorb sell orders. This behavior suggests a range-bound environment, with liquidity being established on both sides prior to a potential expansion. A clear breakdown from the current consolidation would pave the way toward the $82K demand zone, while a sustained recovery above the short-term resistance would be necessary to alter the intraday bias toward the bullish side.

Until such a decisive breakout takes place, the 4-hour structure supports continued choppy price action characterized by liquidity-driven movements rather than significant trend development.

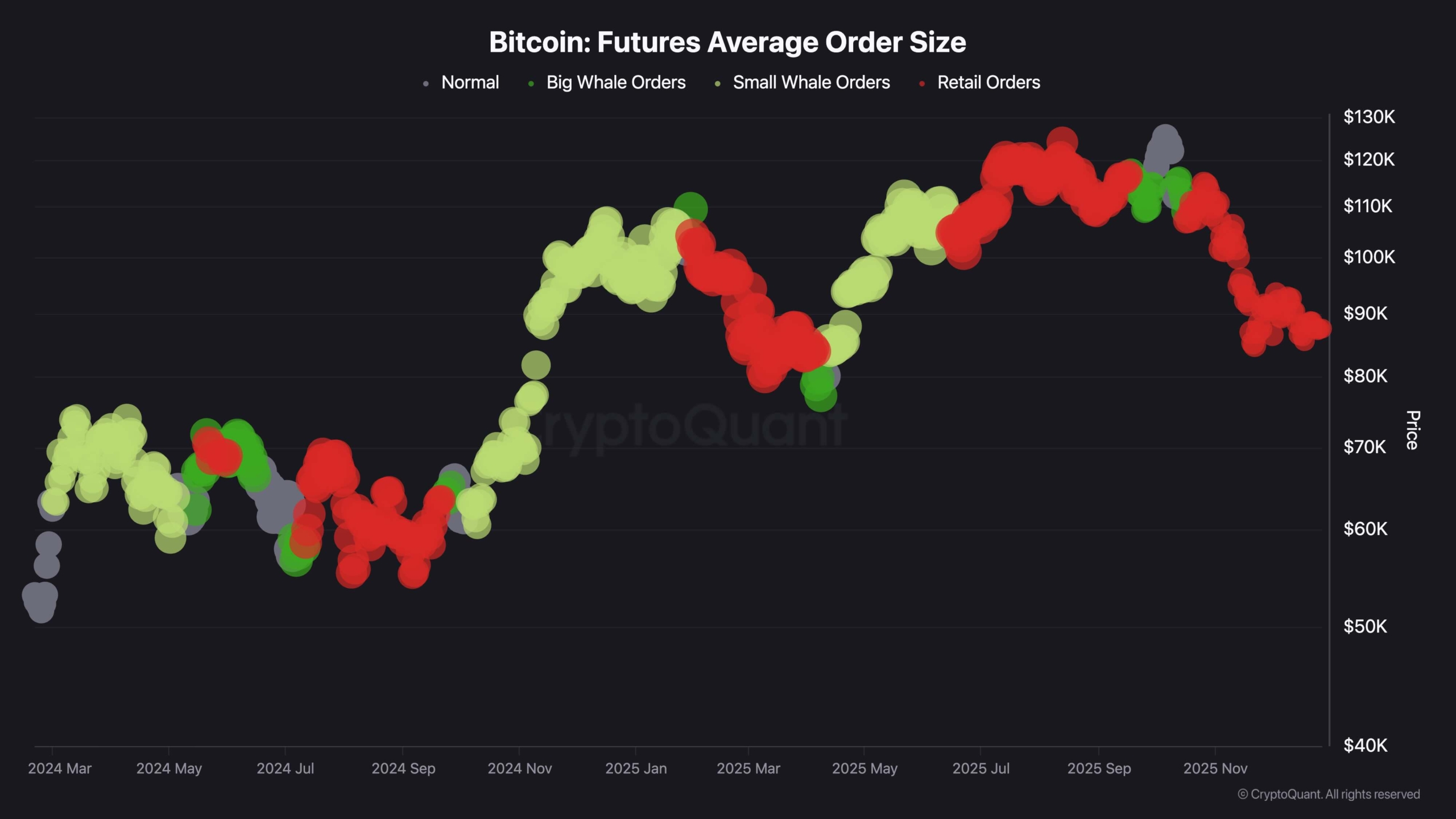

In terms of market sentiment, recent futures order size data reveals a notable shift in participation, with increasing activity from smaller traders. As Bitcoin“s price fluctuates below recent peaks, there is a visible uptick in retail-sized orders, while activity from larger players has notably diminished. This trend typically signifies late-stage participation, where smaller traders engage after major directional movements have already unfolded.

During earlier bullish trends, larger order sizes were more consistently observed, indicating stronger involvement from institutional investors or whales. In contrast, the current market conditions reflect a lack of sustained large orders, suggesting that smart money participation has either paused or adopted a more defensive approach. The predominance of retail-sized futures orders at the current price level supports the notion that recent rebounds are not underpinned by robust conviction from larger players. Historically, this type of order flow imbalance often precedes extended periods of consolidation or further corrective movements, as retail-driven rallies struggle to absorb overhead supply.

Without a clear resurgence in large order activity, the on-chain structure appears to align with a cautious to bearish short-term outlook for Bitcoin.