The White House is reportedly reevaluating its backing for a pivotal piece of cryptocurrency legislation as negotiations continue to stagnate. According to sources close to the matter, if discussions do not advance, a formal withdrawal of support could be announced. This legislative initiative is designed to create a comprehensive regulatory framework for digital assets, yet it faces significant challenges stemming from internal discord and external pressures from financial institutions.

The potential retraction of support from the White House could have profound implications for the regulatory future of the cryptocurrency sector in the United States. The current administration”s shifting stance on the crypto bill highlights the intensifying debates within Washington regarding the management of the rapidly evolving digital asset landscape. Key disagreements over specific provisions of the bill have emerged, which is intended to provide clarity and structure to the growing cryptocurrency market.

Negotiations surrounding this legislation have been stagnant since December 2025, as stakeholders have struggled to achieve consensus on critical regulatory measures. Financial institutions have raised concerns about certain elements of the bill, fearing negative impacts on their operations and market positions. In response, these institutions have been actively lobbying for amendments, further complicating the discussions.

Despite these setbacks, advocates of the bill assert that it is vital for fostering a stable and predictable environment for cryptocurrency enterprises. They contend that a clear regulatory framework would not only spur innovation and investment in the sector but also ensure consumer protection and uphold market integrity.

The prospect of the White House withdrawing its support underscores the complexities inherent in developing regulations for the digital asset ecosystem. The administration faces the challenging task of balancing the interests of the cryptocurrency industry with those of traditional financial entities and consumer protection advocates.

A senior administration official, who requested anonymity, indicated that if negotiations do not improve in the upcoming weeks, the White House may publicly announce its decision to withdraw support for the legislation. This would represent a significant alteration in the administration”s approach to cryptocurrency regulation and could lead to increased uncertainty within the market.

The legislative proposal, which was introduced in Congress in mid-2025, seeks to address essential areas such as market structure, consumer protection, and financial stability. It aims to establish clear guidelines for digital asset issuance, trading, and custodial services. However, the bill”s progression has been impeded by disputes over the degree of regulatory oversight and the role of federal agencies in enforcing the proposed rules.

Reactions from industry participants regarding the possible withdrawal of White House support have been mixed. Some view it as a setback for achieving regulatory clarity, while others perceive it as an opportunity to revisit the bill”s provisions and address the concerns that have arisen during negotiations.

Major players in the industry, including cryptocurrency exchanges and blockchain technology firms, have been engaged in discussions with lawmakers and administration officials. Their involvement is deemed essential in shaping a regulatory framework that effectively balances innovation with necessary safeguards.

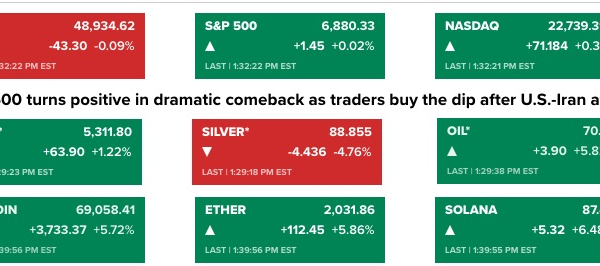

As discussions progress, the White House”s decision will likely carry significant ramifications for the cryptocurrency sector. The outcome of these negotiations will not only influence domestic policy but could also shape international regulatory approaches to digital assets. The situation remains dynamic, with no immediate resolution on the horizon. The ultimate outcome will depend on the ability of involved parties to bridge their differences and establish a common regulatory path for cryptocurrencies in the United States.