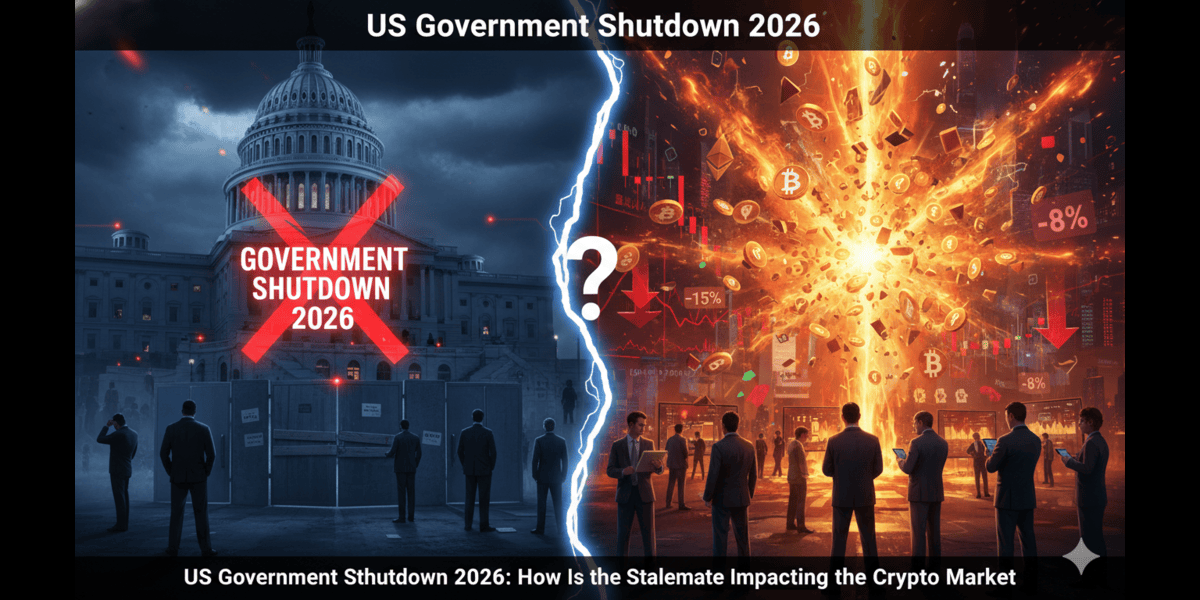

The current US government shutdown in 2026 is creating ripples across various sectors, including the cryptocurrency market. As the stalemate persists, the implications for Bitcoin and associated exchange-traded funds (ETFs) are becoming increasingly significant.

Market analysts are closely monitoring how this political impasse is affecting Bitcoin prices. With uncertainty surrounding government operations, investor sentiment may shift, leading to potential volatility in the cryptocurrency market. The prolonged shutdown could hamper regulatory advancements, leaving many crypto projects in limbo.

Additionally, discussions around cryptocurrency ETFs are gaining traction amidst this political uncertainty. The SEC has been deliberating on various ETF applications, and the current environment may influence their decision-making process. The delay in government functions can slow down the regulatory framework that governs such financial products, complicating the approval timelines for Bitcoin ETFs.

With the SEC and other regulatory bodies facing operational challenges, the future of Bitcoin and its associated investment vehicles remains uncertain. Experts suggest that the resolution of the shutdown might provide clarity and stability, potentially impacting market dynamics positively or negatively.

In conclusion, the 2026 US government shutdown is not just a political issue; it has tangible consequences for Bitcoin prices and the landscape of cryptocurrency regulations. Stakeholders within the crypto space must remain vigilant as they navigate these turbulent waters.