The unveiling of the draft for the US Crypto Market Clarity Act comes at a pivotal time as gold prices surge to record levels. The new legislation aims to clarify the regulatory landscape for cryptocurrencies amidst growing concerns about fiat currencies, highlighted by the Iranian rial reaching unprecedented lows.

As traditional safe-haven assets like gold and silver hit new highs, the Bitcoin market remains cautious, hovering below key resistance levels. The draft of the Clarity Act proposes that most digital assets be classified as commodities under the oversight of the Commodity Futures Trading Commission (CFTC), rather than the Securities and Exchange Commission (SEC). This shift could significantly alter how cryptocurrency projects function and how investors evaluate risks.

SEC Chair Paul Atkins characterized the current week as crucial for the crypto sector, indicating a possible transition from strict enforcement to a structured regulatory framework under the Clarity Act. Atkins expressed support for Congress to delineate the regulatory powers between the SEC and the CFTC, emphasizing the importance of clarity for attracting serious investment.

Moreover, Senator Cynthia Lummis has contributed to the movement by advocating for language that protects Bitcoin developers from being labeled as money transmitters. This provision aims to eliminate legal ambiguities while still ensuring oversight, a factor that proponents believe will encourage investment into the market.

As discussions around the Clarity Act progress, potential hearings may further refine provisions concerning decentralized finance (DeFi) and stablecoin regulations. The market is currently watching these developments closely, as they may determine the trajectory of Bitcoin and other digital assets.

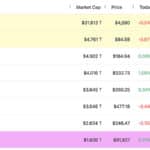

In the meantime, the performance of precious metals reflects a larger trend where investors are seeking value amidst economic uncertainty. Gold reached an impressive price of $4,600 per ounce, while silver climbed above $85, collectively pushing their market capitalization beyond $15 trillion. In contrast, Bitcoin holds a market cap of approximately $1.8 trillion, still considered a smaller player in comparison.

At present, Bitcoin is trading at $91,800, maintaining a position above its 200-day exponential moving average (EMA). Recent market activity saw liquidations surpassing $250 million, predominantly from long positions. However, data indicates that long-term holders are steadfast, sustaining the narrative that Bitcoin may follow in the footsteps of gold.

Technical indicators show a mix of signals, though some suggest a potential stabilization in downside pressure. A break above $94,300 could pave the way for Bitcoin to reach $95,000 or even $100,000, depending on both market dynamics and legislative progress in Washington.

With altcoins remaining on the sidelines for the time being, the focus remains on Bitcoin. If it manages to stabilize, a cycle of capital rotation into altcoins may follow. For now, the clarity offered by the proposed legislation is the key element investors are monitoring.

Stay informed as developments unfold and follow updates on this significant legislative effort shaping the future of digital assets in the US.

For more insights on the cryptocurrency market, visit CoinNewsByte.com.