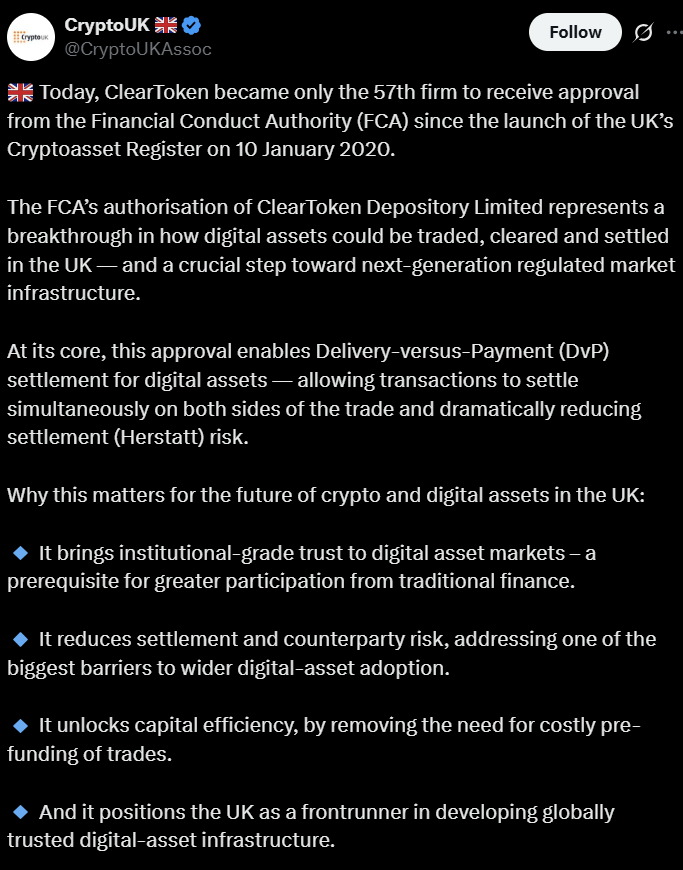

ClearToken has achieved a significant milestone by obtaining approval from the UK”s Financial Conduct Authority (FCA) for its CT Settle platform. This platform is designed for regulated settlement of crypto assets, stablecoins, and fiat currencies, marking a pivotal advancement in the integration of digital assets into the established financial ecosystem.

The approval allows financial institutions to utilize ClearToken”s compliant infrastructure, which is built on the Delivery versus Payment (DvP) model. This mechanism ensures secure and efficient transaction settlements, minimizing risks associated with counterparty defaults and enhancing market integrity.

Niki Beattie, the chair of ClearToken, emphasized that this approval acts as a catalyst for the widespread adoption of digital assets within the UK. The FCA”s endorsement aligns with the country”s broader regulatory framework for cryptocurrencies, which includes ongoing consultations regarding stablecoins led by the Bank of England.

Data from the Bank of England suggests that with clearer regulations, the volume of stablecoin transactions in the UK could witness significant growth, potentially reaching billions in transaction value in the near future. This evolving regulatory landscape addresses institutional concerns and fosters greater efficiency in digital finance.

The FCA”s stringent operational and compliance standards ensure that all transactions conducted through the CT Settle platform adhere to anti-money laundering (AML) and know-your-customer (KYC) regulations, crucial for maintaining the UK”s status as a leading financial hub post-Brexit.

As the UK government develops its draft policy on crypto issuance, custody, and trading activities, it aims to provide a regulatory framework that protects investors while promoting innovation. This approach positions the UK to compete effectively in the global digital asset market, which is currently valued at over $2 trillion.

Financial experts view the FCA”s approval of ClearToken”s platform as a sign of maturation in the cryptocurrency sector, encouraging more banks and financial firms to explore blockchain-based settlements. By tackling issues such as fragmented liquidity and settlement delays, ClearToken”s CT Settle aims to attract institutional capital into the digital asset space.

In conclusion, ClearToken”s FCA approval represents a major step towards integrating crypto assets with traditional finance, potentially increasing market liquidity and efficiency as the UK advances its regulatory framework for digital currencies.