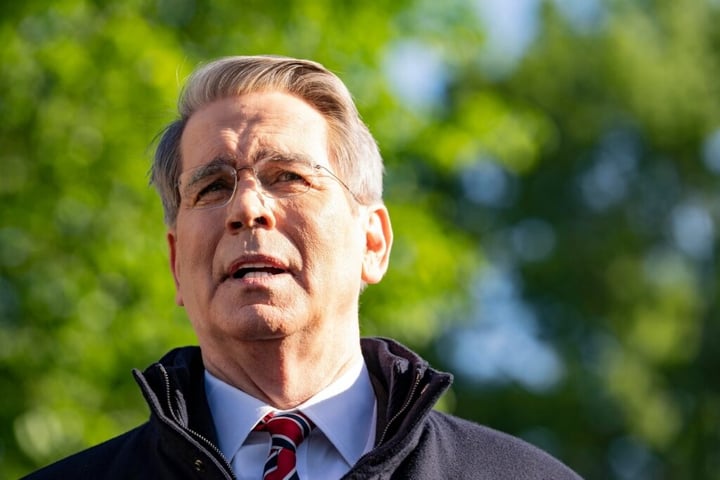

Treasury Secretary Scott Bessent has firmly stated that the U.S. government lacks the legal authority to provide financial support or bailouts for Bitcoin (CRYPTO: BTC). This declaration came during a recent hearing of the House Financial Services Committee, where discussions focused on financial stability risks.

During the session, a lawmaker inquired if the federal government could facilitate Bitcoin purchases by directing banks or using taxpayer money to bolster crypto markets. Bessent decisively rejected this notion, emphasizing that neither the Treasury Department nor any federal regulatory body possesses the power to mandate banks to acquire Bitcoin or invest public funds in cryptocurrencies.

However, Bessent did note that the U.S. government has accumulated Bitcoin through law enforcement actions, treating these assets as government-owned rather than as strategic investments or tools for policy implementation. He highlighted that previously seized Bitcoin, once valued at approximately $500 million, has seen its worth rise to over $15 billion, illustrating the unintentional gains from asset forfeiture rather than any proactive crypto investment strategy.

Regulatory Framework and Future Outlook

In earlier remarks at the World Economic Forum held in Davos in January 2026, Bessent reiterated the objective set by President Donald Trump to establish the U.S. as a frontrunner in crypto innovation, advocating for a regulatory approach over direct market interventions. Additionally, in August 2025, Bessent suggested that stablecoins backed by high-quality assets, such as U.S. Treasuries, could represent a significant demand source for government debt.

Moreover, Bessent has endorsed the implementation of the GENIUS Act, which aims to modernize financial infrastructure and strengthen the Treasury market. His experience as a former hedge fund manager and his established connections on Wall Street are instrumental in shaping these initiatives.

As the cryptocurrency landscape continues to evolve, Bessent”s insights reflect a cautious yet strategic stance on how the government interacts with digital assets, emphasizing regulation and oversight as key components of future policy.