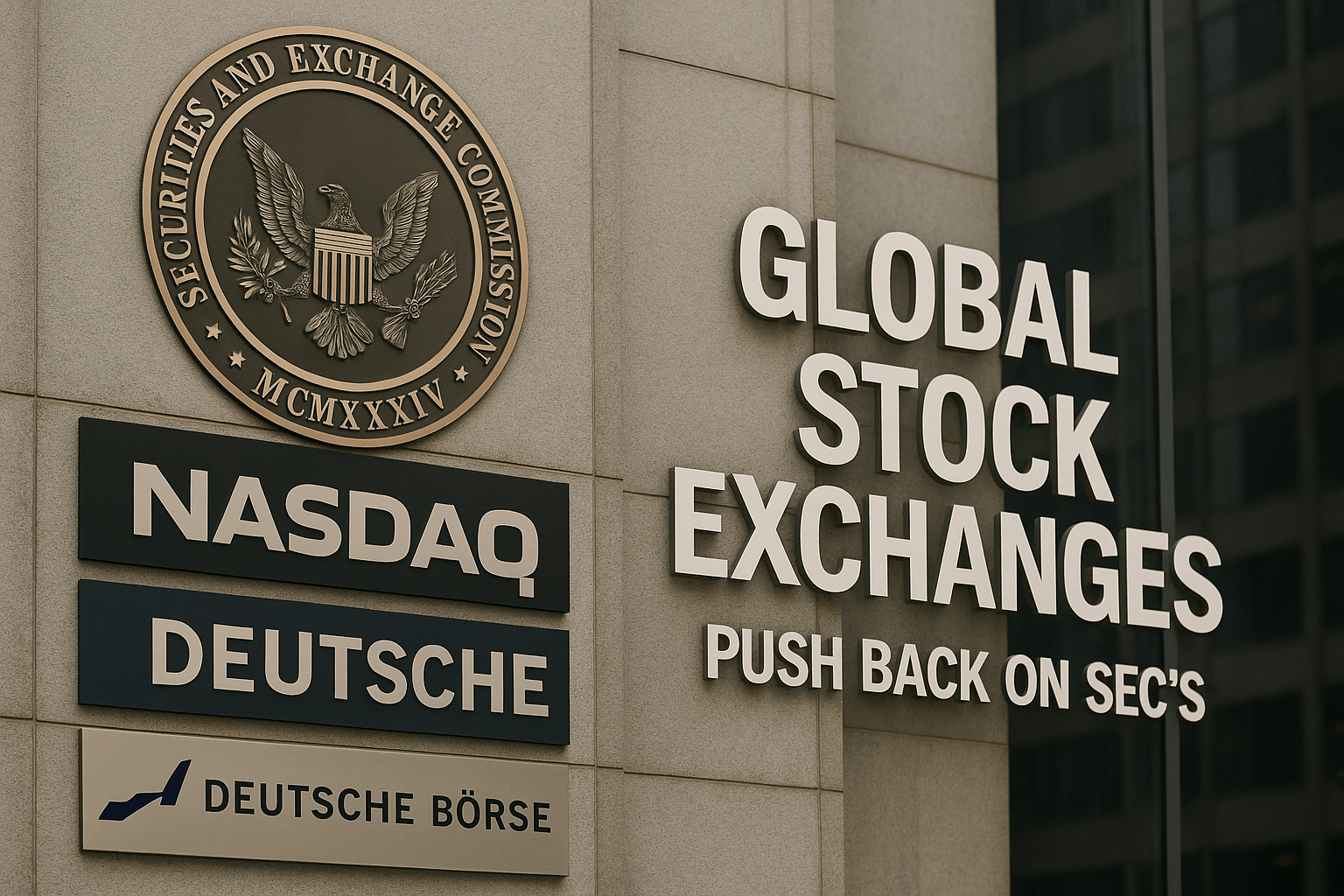

In a significant move that could reshape the regulatory landscape for digital assets, major stock exchanges are voicing their opposition to the U.S. Securities and Exchange Commission”s (SEC) proposed “Innovation Exemption” for cryptocurrency. This exemption aims to provide certain cryptocurrencies with a regulatory safe harbor, allowing for greater flexibility in their development and deployment.

The SEC”s initiative comes amidst a growing demand for clearer regulatory frameworks governing digital assets, as industry players seek to innovate without the looming threat of regulatory backlash. However, exchanges are concerned that this exemption could create an uneven playing field, potentially favoring certain projects while stifling competition.

Critics argue that such exemptions may undermine existing regulations designed to protect investors and ensure market integrity. They stress that any regulatory framework must balance innovation with necessary safeguards to prevent fraud and manipulation in the rapidly evolving cryptocurrency market.

As discussions progress, the tension between fostering innovation and enforcing regulatory standards will be at the forefront. Stakeholders across the cryptocurrency ecosystem are closely monitoring the situation, recognizing that the outcome will have long-lasting implications for the future of digital assets.

In conclusion, the pushback from stock exchanges highlights the complexities of regulating an industry that is constantly evolving. The SEC”s proposed exemption could indeed spur innovation, but it must be approached with caution to ensure it does not compromise the foundational principles of market fairness and transparency.