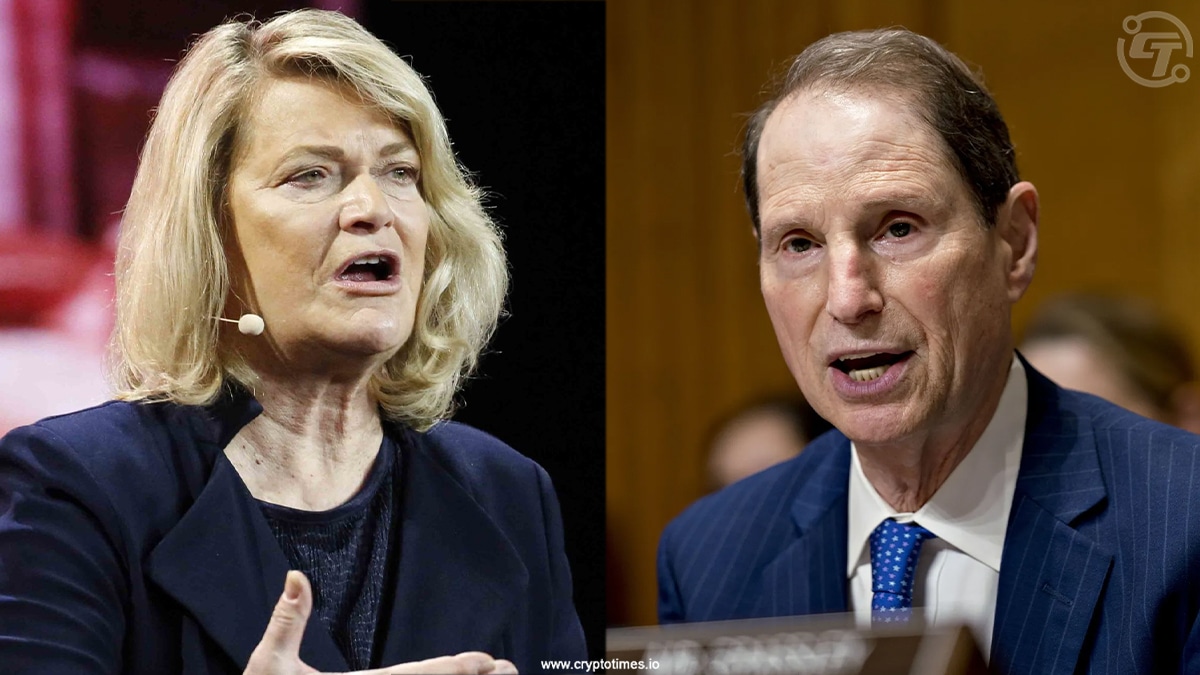

In a significant move for the blockchain sector, US Senators Cynthia Lummis and Ron Wyden have unveiled a bipartisan initiative known as the Blockchain Regulatory Certainty Act of 2026 (BRCA). This legislation aims to alleviate legal ambiguities for blockchain developers who create software without managing customer funds.

The BRCA was introduced as a standalone bill on Monday, even as similar provisions are being deliberated within a broader cryptocurrency regulatory framework in Congress. The core intention is to establish that developers and service providers should not be classified as money transmitters under US law if they do not take custody of user assets.

Senator Lummis emphasized the distinction between coding and controlling finances, stating that developers who contribute to blockchain infrastructure without accessing user funds should not be subjected to the same regulations as financial institutions. “Writing code is not the same as controlling money,” she remarked, reinforcing the idea that developers should not face penalties for activities that do not involve money laundering or custody risks.

This legislative effort comes in response to growing concerns among developers regarding their potential liability stemming from the use of their software by third parties. Recent enforcement actions against crypto projects have intensified fears that writing open-source code could inadvertently place developers in violation of money transmission laws.

Need for Clarity in Regulations

Both Senators Lummis and Wyden advocate for clearer legal definitions to separate financial intermediaries, such as banks and payment processors, from software developers who merely write code or maintain decentralized networks. The bill articulates that individuals or entities that do not handle funds for others should not be classified as money transmitters.

Senator Wyden echoed Lummis”s sentiments, describing the current regulatory expectations as “technologically illiterate” and potentially harmful to Americans” privacy and freedom of speech. He argued that software creators should not be compelled to adhere to rules designed for entities that actively manage or move money.

Implications for Blockchain Innovation

The introduction of the BRCA is seen as a pivotal step toward fostering a more favorable environment for blockchain innovation in the United States. Supporters believe that this legislation could provide essential legal protections for developers of non-custodial and decentralized systems, should it advance through Congress.

While the BRCA does not alter anti-money laundering regulations for custodial platforms or financial firms, its passage could represent a turning point for the blockchain sector, allowing developers to innovate without the looming threat of prosecution for non-custodial activities. The future of this bill remains contingent on Congress”s ability to either advance it independently or incorporate it into the larger crypto regulatory structure.

As the Senate Banking Committee prepares to review the broader legislation this week, the importance of clearly defined regulations has never been more pressing, especially in light of recent cases involving privacy-centric crypto tools, such as those linked to Tornado Cash.