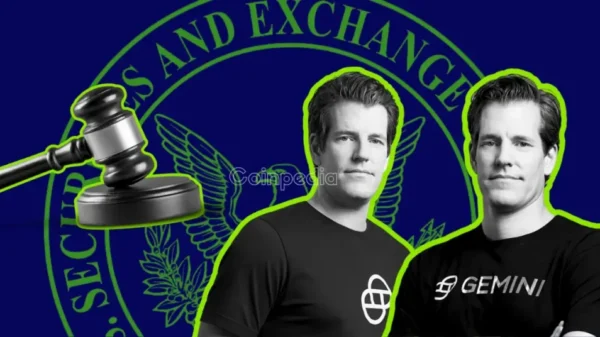

The U.S. Securities and Exchange Commission (SEC) has officially terminated its civil lawsuit against the Gemini Earn program, following successful recoveries of investor funds through the bankruptcy proceedings of Genesis. This decision marks a significant shift in the legal landscape for the company and highlights the evolving regulatory stance on cryptocurrency lending products.

Recent court filings indicate that both the SEC and Gemini have agreed to dismiss the lawsuit “with prejudice,” preventing the regulator from reviving similar claims in the future once a federal judge signs off on the agreement. The lawsuit initially accused the Gemini Earn program of constituting the sale of unregistered securities, as it allowed customers to lend digital assets to Genesis Global Capital in exchange for yield. This arrangement came under intense scrutiny after Genesis faced significant challenges during a broader crypto credit crisis.

The SEC”s decision to withdraw from the case comes on the heels of substantial recoveries for affected investors. Throughout the bankruptcy process of Genesis, customers utilizing the Gemini Earn service received a complete return of their crypto holdings in mid-2024. Additionally, Gemini had previously committed up to $40 million to ensure that investors were made whole, a factor that likely influenced the SEC”s current position.

Previously, Genesis had settled its dispute with the SEC, agreeing to pay a $21 million civil penalty. With investor losses resolved and a separate settlement established, the SEC appeared content to conclude the remaining litigation. The case had been relatively inactive since the SEC paused proceedings in April 2024, coinciding with Mark Uyeda”s tenure as acting chair amid a reassessment of various crypto enforcement actions.

The original lawsuit was filed in January 2023 during a time of heightened regulatory scrutiny over crypto firms, especially concerning lending, staking, and yield-generating products that the SEC argued fell outside existing securities laws. The recent dismissal of the case signals the end of one of the most notable crypto lending disputes that emerged in the wake of the FTX collapse.

As the judge”s final approval is still pending, the joint filing indicates that Gemini, led by the Winklevoss brothers, can now operate without the cloud of this lawsuit hanging overhead. This outcome not only reshapes the future for Gemini but also reflects how resolutions in bankruptcy cases and investor recoveries are influencing the SEC”s strategy regarding historic crypto cases from an extremely volatile period in the industry.

It is essential to note that the information provided herein serves exclusively for educational purposes and should not be interpreted as financial, investment, or trading advice. Readers are encouraged to conduct their own research and consult with a licensed financial advisor before making investment decisions.