In a remarkable display of digital resilience, Iran”s cryptocurrency market achieved a valuation of approximately $7.8 billion last year, as revealed in a crucial analysis conducted by blockchain analytics firm Chainalysis. This noteworthy figure highlights a significant transformation in how Iranians are protecting their financial assets amidst the ongoing anti-government protests and stringent internet restrictions.

The Chainalysis report offers valuable insights into Iran”s intricate financial landscape. The $7.8 billion valuation reflects not just market dynamics but signifies the emergence of a parallel economic system that has gained traction during periods of heightened civil unrest. Researchers found a clear link between major protests, government-enforced internet blackouts, and a notable increase in Bitcoin (BTC) withdrawals from centralized exchanges. This trend suggests that citizens are actively moving their assets off exchanges to safeguard them against potential freezes or seizures.

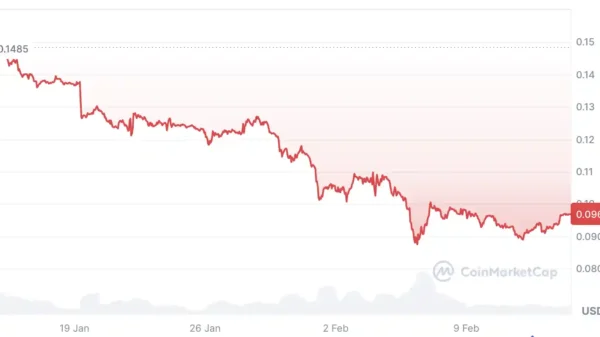

Amid ongoing devaluation of the Iranian rial, which has significantly diminished public savings, cryptocurrencies have evolved from being niche investments to essential safe-haven assets. In this context, Bitcoin has become a censorship-resistant store of value, distancing itself from the tightly controlled traditional banking system, which is heavily impacted by international sanctions.

The report outlines distinct use cases for various cryptocurrencies within Iran, emphasizing their roles in everyday transactions and long-term wealth preservation:

- Bitcoin (BTC): Used primarily for long-term value storage and capital preservation as a hedge against currency devaluation and censorship.

- Stablecoins (USDT, USDC): Serve as a medium for remittances, daily commerce, and cross-border trade, providing price stability essential for financial transactions.

This functional distinction is vital for understanding the structure of Iran”s crypto market. While Bitcoin acts as a digital gold, stablecoins function as practical proxies for the US dollar, facilitating daily economic activities in a country largely isolated from the global financial system.

Protests as a Catalyst for Crypto Adoption

The protests that erupted late last year significantly accelerated cryptocurrency adoption. By restricting internet access in an effort to quell dissent, authorities inadvertently highlighted the robustness of blockchain networks. Transactions involving Bitcoin can continue through decentralized methods such as satellite or mesh networks, demonstrating a unique value proposition during communications crackdowns.

During these turbulent times, citizens reportedly utilized cryptocurrencies to:

- Protect their wealth from possible asset seizures or bank account freezes.

- Access global markets despite stringent capital controls.

- Receive remittances from overseas, sidestepping costly and monitored traditional channels.

This real-world application emphasized the operational utility of decentralized finance tools in an authoritarian setting, driven not by speculation but by necessity. The surge in withdrawals indicates a growing understanding among users of the importance of self-custody during periods of political instability.

Geopolitical and Regulatory Challenges

Iran”s stance on cryptocurrency presents a complex paradox. While the government has expressed interest in utilizing digital assets to navigate economic sanctions and facilitate imports, it simultaneously regards decentralized, citizen-led crypto activities with wariness. This has resulted in a fluctuating approach, oscillating between proposing central bank digital currencies (CBDCs) and imposing crackdowns on unauthorized trading.

Furthermore, the Chainalysis report unearthed a controversial finding: addresses linked to the Islamic Revolutionary Guard Corps (IRGC) represented over 50% of all cryptocurrency inflows into Iran in the last quarter of the year. This data underscores the dual-use nature of the technology, as it empowers both citizens and state-affiliated entities to move capital.

The Role of Stablecoins in Everyday Transactions

While Bitcoin has garnered attention for its role as a safe haven, stablecoins have become integral to daily economic activities. Assets like Tether (USDT), pegged to the US dollar, are utilized in a hyperinflationary environment to provide a reliable means of exchange. Merchants and individuals leverage stablecoins for transactions without fearing drastic fluctuations in the rial”s value.

Moreover, stablecoins offer a speedy and economical alternative for remittances, allowing migrant workers to send USDT to family members in Iran efficiently. Recipients can convert these assets to rials through local peer-to-peer exchanges or use them directly for purchases, emphasizing the grassroots adoption driven by economic necessity rather than speculative trading.

Financial technology analysts identify several factors that will shape the future of Iran”s cryptocurrency market. The ongoing devaluation of the rial is likely to push more individuals toward crypto assets. However, the technical knowledge required for effective self-custody presents a barrier to widespread adoption, limiting activity to a more tech-savvy demographic. Furthermore, the constant threat of government crackdowns on peer-to-peer platforms introduces an element of uncertainty.

In conclusion, Iran”s burgeoning $7.8 billion cryptocurrency market serves as a compelling case study in the practical application of digital assets under duress. It highlights how tools such as Bitcoin and stablecoins provide crucial financial lifelines during times of protest, censorship, and economic crisis. The market”s growth is a direct reflection of systemic failures, underlining the role of cryptocurrency as both a refuge for citizens and a complex instrument for state actors.