The ongoing debate regarding cryptocurrency regulation in the United States has intensified, particularly after Charles Hoskinson, the founder of Cardano, publicly criticized Brad Garlinghouse, CEO of Ripple, for his endorsement of the Digital Asset Market CLARITY Act. This act is currently one of the most significant legislative efforts aimed at providing a regulatory framework for the digital asset industry.

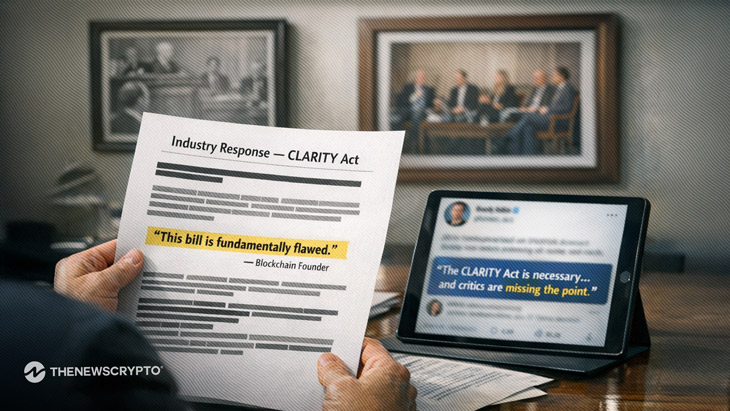

Hoskinson”s remarks, made during a broadcast on X, reflect the growing rift among prominent figures in the cryptocurrency space over the future of U.S. crypto policy. The CLARITY Act seeks to clarify the legal status of digital assets and delineate the roles of the SEC and CFTC as regulatory bodies. However, the draft version has faced criticism from various corners, including Hoskinson, who argues that it contains critical gaps in its policy formulation.

In his defense of the act, Garlinghouse has emphasized the necessity of having a clear legal framework to foster capital and innovation in the cryptocurrency sector. He contends that even flawed legislation is preferable to an environment filled with regulatory ambiguity. Hoskinson, however, leverages Garlinghouse”s statements to challenge the logic behind supporting a bill that he believes does not adequately protect smaller projects within the industry.

This incident underscores a broader conflict within the crypto community, where differing opinions on regulation and innovation strategies reveal deep divides. As discussions around the CLARITY Act continue, the contrasting perspectives of industry leaders like Hoskinson and Garlinghouse will likely play a crucial role in shaping the future of cryptocurrency regulation in the U.S.

The outcome of the CLARITY Act deliberations holds significant implications for the entire cryptocurrency ecosystem, influencing how existing and future projects will navigate the regulatory landscape. Stakeholders across the board are closely watching these developments as they could determine the overall longevity and success of innovation in the digital asset space.