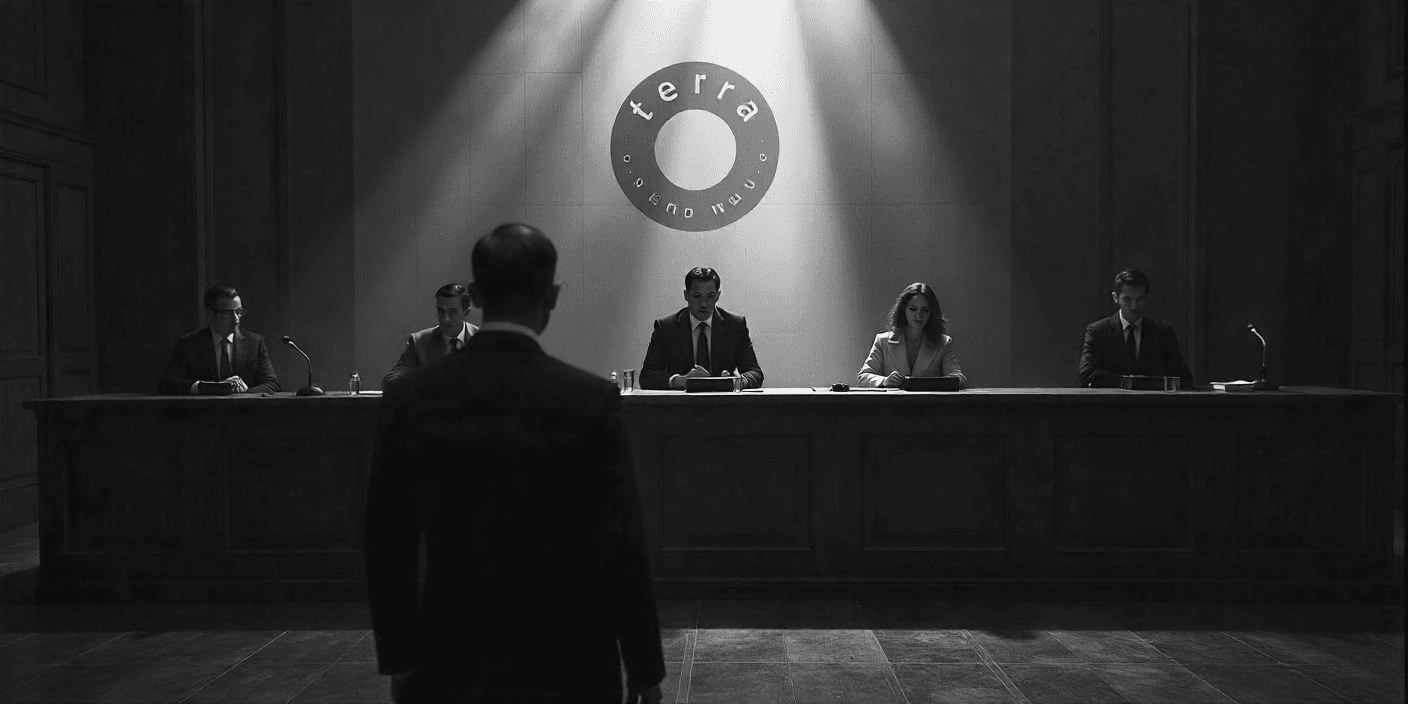

Do Kwon, the controversial figure behind the Terra collapse, is making a significant legal move as he approaches sentencing. Kwon is advocating for a maximum prison term of five years for his involvement in the dramatic downfall of the Terra ecosystem, which resulted in a staggering $40 billion loss in market value.

Kwon”s legal team has presented a comprehensive 23-page letter to a U.S. court, arguing that a five-year cap would be a proportionate punishment. They assert that the government”s recommendation of a 12-year sentence fails to consider the broader context of the Terra collapse and Kwon”s actions since then. The defense portrays Kwon as a young entrepreneur who became overwhelmed, rather than as a mastermind of fraudulent activities aimed at personal profit.

The collapse of Terra-Luna is a pivotal event in the cryptocurrency landscape. It was not merely a routine failure; it triggered widespread ramifications that reverberated throughout the entire digital asset market. Kwon has already admitted guilt to two fraud-related charges that stem from the May 2022 crash of Terraform Labs” ecosystem, which included the algorithmic stablecoin TerraUSD (UST) and its companion token Luna.

In their defense, Kwon”s lawyers highlight that external factors significantly contributed to the collapse, citing coordinated trades by third-party actors that exploited vulnerabilities within the system. They reference academic studies and Chainalysis reports indicating that these external players may have played a crucial role in exacerbating the situation. Furthermore, the defense acknowledges Kwon”s prior undisclosed agreement with Jump Trading, which was intended to support UST”s peg but argues that this decision was driven by overconfidence rather than a fraudulent intent.

Several key factors are emphasized by Kwon”s legal team to sway the judge. They point out that Kwon did not personally benefit from the crash; instead, his decisions were influenced by ego and the pressures of an escalating crisis. Additionally, they bring attention to Kwon”s nearly two-year detention in Montenegro, which included solitary confinement, as evidence of the hardship he has already endured. This detention followed his arrest in March 2023 for attempting to travel with a fake passport, and he remained in custody until his extradition to the United States in December 2024.

However, even if the U.S. court grants Kwon”s request for a five-year sentence cap, his legal woes are far from over. He is also facing a separate trial in South Korea, where prosecutors are pursuing a much steeper penalty of up to 40 years on similar charges. Kwon”s defense acknowledges this reality, framing it as another reason for the U.S. court to impose a shorter sentence.

The impending sentencing, scheduled for December 11, is a crucial moment for Kwon and the cryptocurrency community at large. The outcome will depend on how the court weighs the extensive financial damage caused, Kwon”s admitted errors, the alleged external manipulations, and the significant time he has already spent in detention. As one of the most significant legal narratives in the crypto sector approaches a major turning point, the question remains: how much accountability is deemed sufficient for an incident that reshaped the industry?