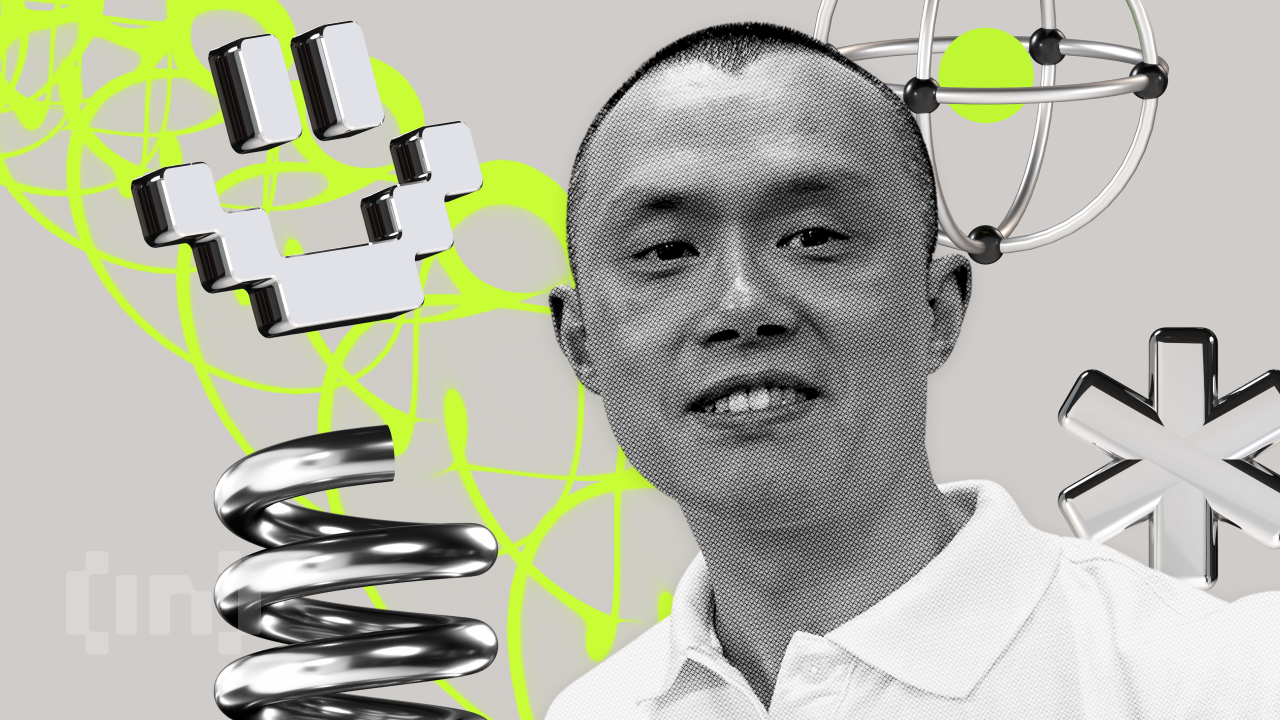

Changpeng Zhao, known as CZ, has publicly rejected misleading claims circulating online about a supposed filing by BlackRock for a staked Aster (ASTER) exchange-traded fund (ETF). This rumor gained traction after a post on social media suggested that BlackRock, the leading global asset manager, had submitted an S-1 registration document concerning an “iShares Staked Aster Trust ETF” to the Securities and Exchange Commission (SEC).

The post, which included a seemingly official document dated December 5, 2024, sparked significant speculation about potential institutional interest in ASTER. However, a thorough investigation revealed no evidence of such a registration in actual SEC filings. The document in question was identified as a forgery, closely mimicking legitimate SEC submissions, making it challenging to detect at first glance.

Upon closer examination, the description in the forged document actually pertained to the iShares Staked Ethereum Trust ETF, a genuine filing by BlackRock. The asset management firm has consistently emphasized that its current focus on cryptocurrency ETFs is primarily on Bitcoin and Ethereum.

CZ responded to the viral misinformation by warning his followers about the risks of being misled, even by prominent voices within the cryptocurrency community. “Fake. Even big KOLs gets fooled once in a while. Aster doesn”t need these fake photoshopped pics to grow,” he stated.

The connection between CZ and Aster is well-documented, as he has been an outspoken supporter of the decentralized derivatives exchange. In September, he reaffirmed his backing for the platform, and YZi Labs, previously known as Binance Labs, holds a minority stake in the exchange. Moreover, in November, CZ disclosed that he had made a personal investment of approximately $2 million in ASTER tokens, which led to a notable price increase in the token.

Despite recent efforts to bolster its market position, the ASTER token is currently experiencing downward pressure. On December 8, the Aster team announced an accelerated buyback initiative, increasing daily purchase volumes to around $4 million, up from a previous rate of approximately $3 million. The purpose of this acceleration is to bring the accumulated Stage 4 fees on-chain more swiftly, providing stronger support during turbulent market conditions.

However, the announcement has not yet translated into positive price movement for ASTER. In fact, the token has recorded a decline of nearly 4% over the past 24 hours, compounding its recent losses. As of this writing, ASTER is trading at $0.93, with trading volume also experiencing a significant drop of 41.80%.