The cryptocurrency landscape has showcased an unexpected sense of stability in the wake of former President Donald Trump”s announcement regarding a sweeping 10% tariff on all imports entering the United States. Contrary to previous instances of economic tension that typically incite volatility, traders in digital assets responded with caution rather than chaos, resulting in minimal price fluctuations.

Trump”s latest tariff initiative is designed to bolster the American economy and comes on the heels of a Supreme Court ruling that limited the administration”s emergency economic powers. This new 10% tariff reflects a sustained commitment to his assertive trade policies, now necessitating legislative approval due to the legal precedent set by the Supreme Court. The comprehensive nature of this tariff initiative marks a departure from previous trade measures enacted during Trump”s earlier term.

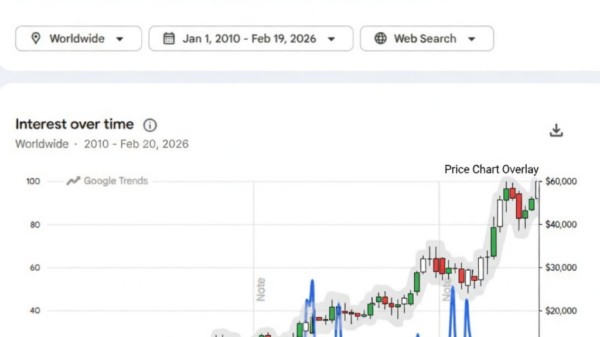

In terms of market reaction, leading cryptocurrencies such as Bitcoin and Ethereum exhibited little volatility, with Bitcoin remaining around $67,800 and Ethereum hovering close to $1,960. The overall cryptocurrency market capitalization stood at approximately $2.33 trillion, experiencing only slight changes post-announcement. This restrained response indicates a prevailing sentiment of prudence among market participants, contrasting sharply with past situations where global trade tensions triggered significant movements in risk-sensitive assets.

Notably, major cryptocurrencies including XRP and BNB demonstrated negligible price variations, suggesting that fear-driven trading was not a motivating factor following Trump”s tariff announcement. Historically, Trump”s administration had previously imposed similar tariffs, notably a 10% tariff on imports from China. However, the recent Supreme Court ruling highlighted the requirement for congressional consent in such economic measures, underscoring the importance of legislative oversight in trade policy matters.

Blockchain analytics reveal a 16% decrease in Bitcoin wallets containing over $1 million since the beginning of Trump”s latest term, marking a significant decline in the number of large holders. Approximately 25,000 addresses fell below this threshold, with major investors witnessing a 12.5% reduction in their holdings. This trend suggests that while larger investors have shown resilience, smaller participants have faced more pronounced impacts.

The tariff decision has drawn criticism from various quarters, including California Governor Gavin Newsom, who voiced concerns over its fairness. The subdued reaction of the cryptocurrency market to this latest tariff announcement may indicate a maturation among traders, suggesting that they are better equipped to handle economic policy shifts with a degree of composure previously unseen.