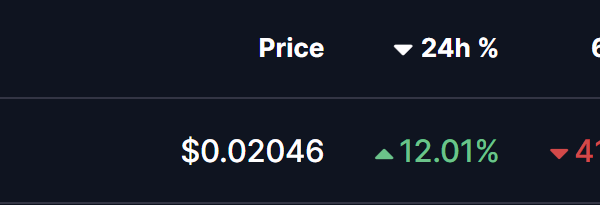

The landscape of illicit cryptocurrency activities has seen a significant escalation, particularly involving Chinese-language money laundering networks (CMLNs), which reportedly processed $16.1 billion in illicit funds in 2025. This figure translates to approximately $44 million a day, encompassing over 1,799 active wallets. The data emerges from Chainalysis” latest insights highlighted in the forthcoming 2026 Crypto Crime Report.

Chainalysis notes that the overall on-chain money laundering ecosystem has surged from around $10 billion in 2020 to an anticipated $82 billion by 2025. This rapid growth underscores the increasing accessibility and liquidity of cryptocurrencies, as well as a transformation in the methods and participants involved in laundering activities.

In 2025, CMLNs accounted for roughly 20% of all recognized illicit laundering activities. These networks have become pivotal conduits for funds obtained through scams, particularly pig butchering schemes, as criminals increasingly turn away from centralized exchanges that retain the ability to freeze assets. Notably, inflows to identified CMLNs have increased at a staggering rate, growing 7,325 times faster than those to centralized exchanges since 2020.

The report identifies six primary service categories within the CMLN ecosystem responsible for the $16.1 billion processed. The number of active entities within this framework has expanded significantly, demonstrating the industrial capacity of these networks. Among the notable services are “guarantee platforms,” which serve as marketing and escrow hubs, connecting laundering service providers with clients. Key players in this sector include platforms like Huione and Xinbi.

These services offer a diverse array of laundering techniques, including money mule operations, informal over-the-counter transactions, and gambling-associated laundering options. Despite regulatory actions targeting specific accounts, these networks often exhibit adaptability by migrating across different platforms while maintaining operational continuity.

The escalation of money laundering activities facilitated by CMLNs presents substantial national security concerns. Recent enforcement actions, including sanctions and advisories from the Office of Foreign Assets Control (OFAC) and the Financial Crimes Enforcement Network (FinCEN), highlight the risks posed by these laundering networks. Experts warn that the cross-border transfer of illicit funds via cryptocurrencies has become alarmingly rapid.

To effectively combat these threats, Chainalysis advocates for a coordinated response that integrates public and private sector efforts, leveraging blockchain analytics, intelligence sharing, and targeted actions against the core operators of these networks, rather than focusing solely on individual platforms. The potential for on-chain transparency is significant but can only be fully realized through enhanced global enforcement capabilities and collaborative strategies.