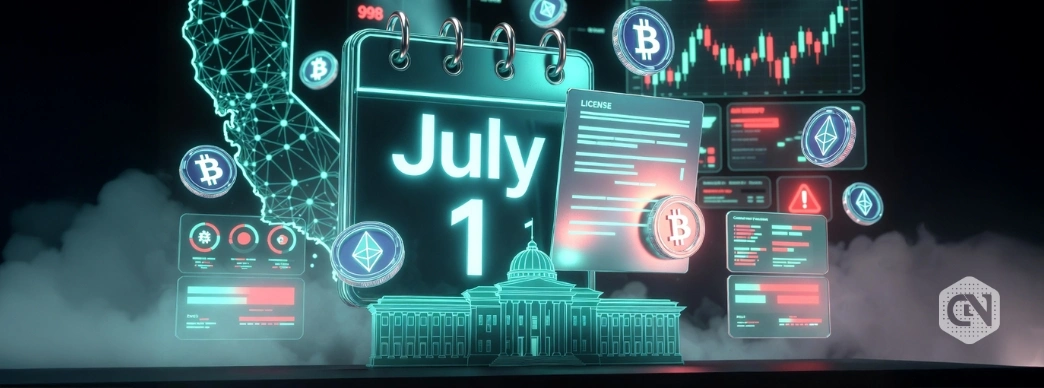

California is advancing its regulatory framework for the cryptocurrency sector, introducing new licensing requirements for digital asset companies. The California Department of Financial Protection and Innovation has established a deadline of July 1, 2026, by which firms must secure a license, submit an application, or qualify for an exemption to continue offering services.

This regulatory update is part of the implementation of the Digital Financial Assets Law (DFAL), aiming to ensure that crypto businesses adhere to specific operational standards and safeguard users from potential risks in the industry.

Countdown to Compliance Begins

With the announcement, crypto businesses operating in California face a clear timeline for compliance. They are required to fulfill one of three conditions: obtain a DFAL license, apply for one, or meet the criteria for an exemption. The application process will open on March 9 through the Nationwide Multistate Licensing System, allowing companies to begin their licensing journey.

Joe Ciccolo from the California Blockchain Advocacy Coalition highlighted the significance of California”s regulatory decisions, noting that the state ranks as the fourth-largest economy globally. He emphasized that while DFAL is a state initiative, firms seeking access to California”s market may need to align their compliance strategies on a national scale.

Training and Preparation for Industry Players

To assist businesses in navigating the new licensing landscape, California regulators will host an industry training session on March 23. This session aims to prepare companies for the licensing process and familiarize them with the necessary requirements outlined in the NMLS checklist. The move to implement stringent licensing regulations follows a broader trend of increased oversight in the cryptocurrency sector, reflecting California”s commitment to user protection while fostering industry growth.

The introduction of these licensing rules comes on the heels of California”s previous initiatives, such as the Bitcoin Bill of Rights, which aimed to uphold self-custody rights for Bitcoin users. However, the current regulations have sparked discussions reminiscent of New York”s stringent crypto licensing framework, which led to the exit of notable exchanges like Kraken and Bitfinex from the state.

Regulatory Impact on the Crypto Landscape

As speculation mounts regarding the implications of California”s regulatory approach, some industry observers suggest that while tougher regulations may drive smaller or less prepared firms out of the state, they could also attract more established players and institutional investors. Ciccolo remarked, “Clear rules tend to attract serious operators and institutional capital,” indicating a potential shift in the competitive landscape as firms adapt to the new environment.

The evolving regulatory framework in California stands as a critical development for the cryptocurrency sector, illustrating the state”s intent to balance oversight with the need for innovation and growth in this rapidly changing industry.