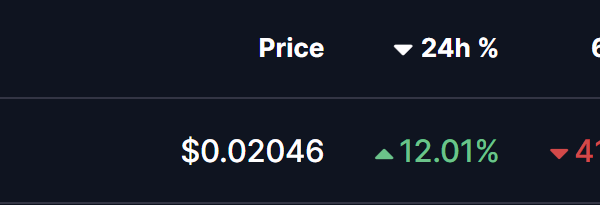

The Arizona Senate Finance Committee has taken a significant step by advancing two measures aimed at exempting cryptocurrency from property taxation. This move, marked by a 4-3 vote, seeks to alleviate the complex tax obligations associated with digital assets for residents in the state.

Senate Bill 1044 will formally exempt cryptocurrency from property taxes, while Senate Concurrent Resolution 1003 (S.C.R. 1003) proposes a constitutional amendment to reinforce this exemption. If S.C.R. 1003 successfully navigates the legislature, it will be presented to voters this November, asking them to decide whether to explicitly define digital currency in the state constitution and ban its ad valorem taxation.

S.B. 1044 aims to update existing state laws to align with this exemption, defining cryptocurrency as “a digital representation of value that functions as a medium of exchange, a unit of account, and a store of value other than a representation of the United States dollar or a foreign currency.”

Senator Wendy Rogers (R-Ariz.), the sponsor of these bills, has previously attempted similar legislation. Last year, her proposal for a property tax exemption for cryptocurrency gained Senate approval but ultimately stalled in the House. This legislative push is part of a broader initiative to establish Arizona as a leading state for cryptocurrency.

Throughout recent legislative sessions, Rogers has introduced several ambitious proposals, including those related to a strategic Bitcoin reserve and changes to crypto tax policies. However, she has faced resistance from the office of Arizona Governor Katie Hobbs, who has vetoed multiple crypto-related bills, including those addressing a strategic Bitcoin reserve and digital asset funds.

Despite the pushback, Governor Hobbs did sign legislation last year allowing crypto assets that are unclaimed property to be retained in their original form rather than liquidated. This mixed approach has positioned Arizona as cautiously welcoming to cryptocurrency while simultaneously resisting more extensive adoption and state exposure.

The advancement of these bills signals a renewed focus on simplifying cryptocurrency taxation in Arizona, which remains a complex issue for many who own digital assets. As the situation develops, the outcome of these legislative measures could significantly impact the state”s approach to cryptocurrency taxation.