ZCash (ZEC) demonstrated significant activity in November, both on exchanges and within its blockchain network. The ZCash chain outperformed major competitors like Ethereum and Solana in terms of fee generation, achieving record levels of on-chain activity during this period.

The surge in usage for ZEC coincided with its rally, where the coin”s price surpassed $700. This spike in activity was evident on both its mainnet and the Solana-based version of ZCash, which operates within decentralized finance (DeFi) environments.

For the past 30 days, ZCash edged ahead of both Solana and Ethereum, ranking just behind TRON as the second-largest network in terms of fees produced. This achievement came despite ZCash lacking a wide array of applications compared to its competitors. The increase in transactional volume was partly attributed to the usage of the Orchard privacy pool, which facilitated near-record transfers of ZEC for bridging and transitioning to its private version.

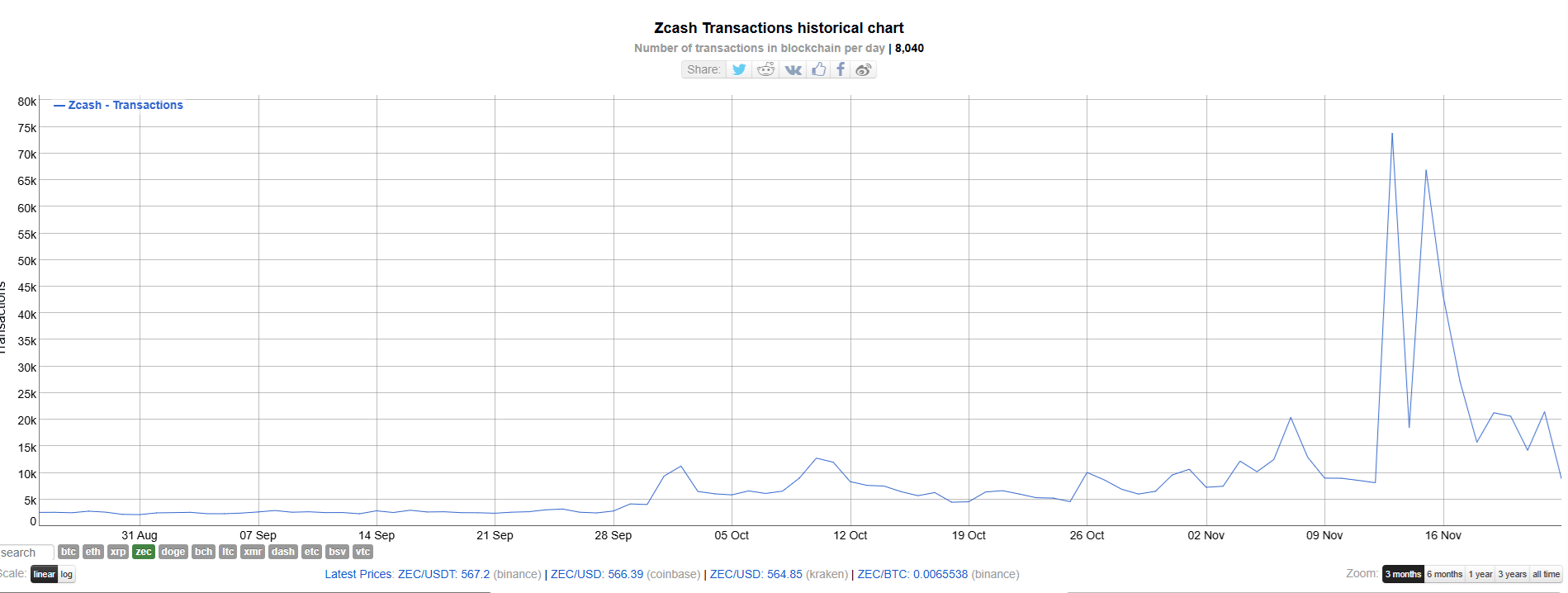

In total, ZCash generated $47.5 million in fees, which represents approximately 2.6% of the total fees produced by major blockchains. Notably, transaction counts peaked on November 13, exceeding 73,000 in a single day. After this peak, the transaction rate established a new, elevated baseline.

Historically, ZCash has seen minimal transaction activity, despite aspirations to rival Bitcoin (BTC). However, the recent uptick in on-chain activity has been driven by a relatively small number of active wallets. Currently, ZCash ranks 13th in terms of daily active wallets, with about 11,590 wallets engaging on its main network.

The recent price rally led to speculation that ZEC could serve as an exit strategy for early adopters, miners, or whales engaged in trading. Following an ascent that reached levels not observed since 2018, ZEC encountered resistance above the $700 mark, retreating to approximately $562.94 after failing to sustain its upward momentum.

Privacy-focused cryptocurrencies as a whole have seen a decline, with their total market capitalization dropping below $20 billion. Despite this, ZCash remains at the forefront, followed by Monero (XMR). Many smaller privacy coins have also receded from their earlier gains.

Interestingly, 55% of the open interest in ZEC is tied to short positions, although only 44% of whales trading on Hyperliquid are currently shorting ZEC. Among these whales, many are incurring substantial fees to maintain their positions. The volatility of the ZEC rally suggests that it could potentially eliminate shorts up to the $620 level.

In the short term, the prospect of ZEC reclaiming levels above $700 appears slim, considering current open interest dynamics and the likelihood of further short squeezes. Some analysts theorize that ZEC is being used as a means to anonymously liquidate older Bitcoin positions, particularly as a record number of long-held BTC coins are being moved.

As the market continues to evolve, ZCash remains a focal point, reflecting the complexities of trading behavior and the persistent interest in privacy coins within the broader cryptocurrency ecosystem.