The cryptocurrency XRP witnessed a 4.3% drop, falling from $2.31 to $2.22, even after the launch of the XRPC ETF by Canary Capital. This decline occurred in the backdrop of persistent weakness across the cryptocurrency market, particularly with Bitcoin, which continues to struggle under bearish sentiment.

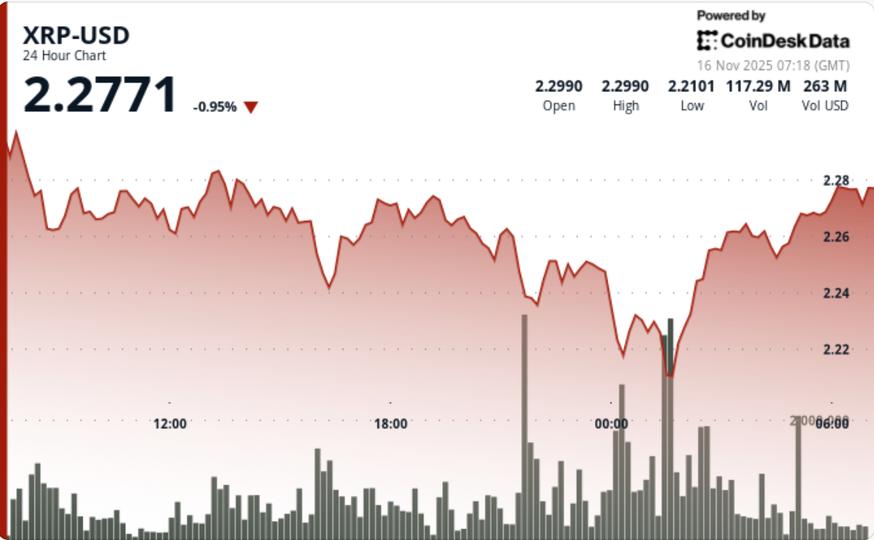

The market”s overall sentiment remains strained, evidenced by XRP”s inability to break through the resistance levels at $2.23 to $2.24. This resistance zone has proven to be a significant hurdle, as XRP faced considerable selling pressure at important support levels. A brief, high-volume V-shaped reversal hinted at a potential exhaustion of the downward trend, but that relief was short-lived.

On the day of the ETF”s launch, the XRPC ETF recorded an impressive $58.6 million in trading volume on its first day, far surpassing analyst predictions of $17 million. Despite this strong debut, XRP”s price failed to stabilize, as the derivatives market showed signs of stress. Within a 24-hour window, approximately $28 million in XRP positions were liquidated, predominantly from long positions, which accounted for nearly $25 million of the total.

Market analysts have noted conflicting signals regarding institutional flows. While ETF inflows indicate strong interest, the broader risk-off sentiment continues to hinder liquidity and momentum in the cryptocurrency market. The recent price action saw XRP carving out a $0.10 range during the session ending November 16 at 02:00 UTC, with a series of lower highs marking a bearish trend.

The most aggressive selling occurred around midnight UTC, when 74 million XRP were traded—69% above the daily average. This surge in trading volume broke through the $2.24 support, pushing the price down to a session low of $2.22. Additional volume spikes above 57 million during decline phases confirmed ongoing distribution pressure.

From a technical standpoint, XRP”s price hammered into support overnight, resulting in a classic V-shaped reversal pattern. The formation of higher lows at $2.209, $2.217, and $2.227 suggested a shift in momentum. However, the overarching downtrend from $2.31 remains unbroken, pending a reclaim of the resistance zone at $2.23 to $2.24.

For traders, maintaining a hold above $2.22 is critical, as a failure to do so could lead to a swift decline towards the critical Fibonacci support at $2.16, potentially targeting $2.02 to $1.88. A confirmed reclaim of $2.24, followed by $2.31, is necessary to reestablish a bullish market structure. The ETF flows are expected to influence volatility, making it essential to monitor early XRPC volume at the U.S. market open.

While the recent V-shaped rebound provides temporary relief, the significant resistance overhead continues to limit immediate upside potential. A sustained breakout above $2.48 is required to shift the trend bias back towards targets above $2.60.