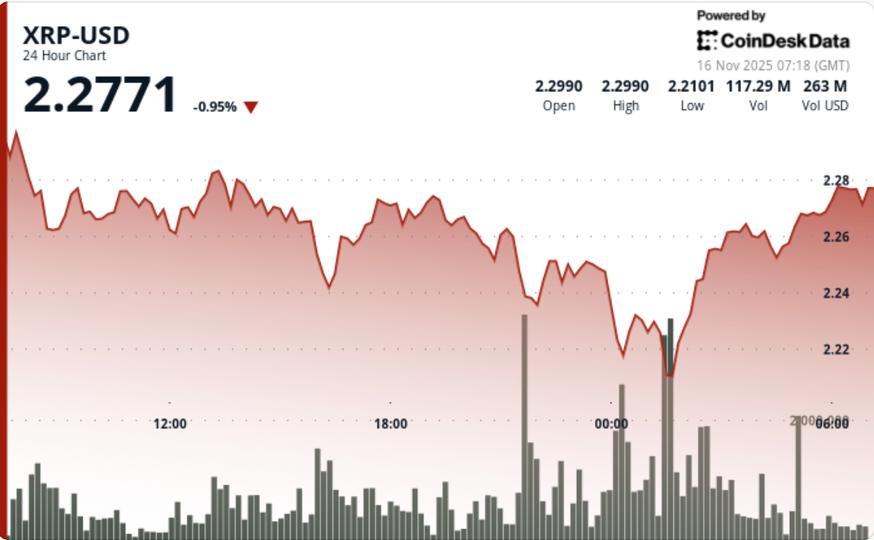

XRP experienced a notable decline of 4.3%, dropping from $2.31 to $2.22, despite the recent launch of the XRPC ETF by Canary Capital. This downturn occurred within a trading session that concluded on November 16 at 02:00 UTC, reflecting ongoing weakness in the broader cryptocurrency market, particularly influenced by Bitcoin.

The decline unfolded against a backdrop of mixed institutional signals and increased macroeconomic uncertainty. Currently, the cryptocurrency markets are entrenched in a medium-term downtrend, with market sentiment firmly placed in the fear zone. This environment has been characterized by heightened volatility across major cryptocurrencies.

Despite the strong debut of the U.S. spot XRP ETF, which registered an impressive first-day volume of $58.6 million—significantly surpassing analysts” expectations of $17 million—this positive development was unable to stabilize the price of XRP. The derivatives markets displayed signs of stress, with approximately $28 million in XRP liquidations occurring within a 24-hour period, primarily affecting long positions.

Market analysts have indicated that institutional flows are presenting a conflicting picture. While the inflow associated with the ETF indicates a level of interest, the prevailing risk-off sentiment continues to suppress overall liquidity and momentum in the cryptocurrency space.

During the session, XRP”s price action displayed a clear bearish structure, carving a range of $0.10 with a sequence of lower highs. The most aggressive selling occurred at midnight UTC, when trading volumes spiked to 74 million XRP—69% above the average for the 24-hour period—resulting in a breach of the critical support level at $2.24. The price subsequently fell to $2.22, marking the session”s low.

Throughout the decline, three separate volume spikes exceeding 57 million XRP validated a pattern of sustained distribution. Despite the ETF launch serving as a catalyst, the selloff continued as the price rejected $2.31 and struggled to find support near previous consolidation zones. Following this breakdown, the trading pair settled into a narrow consolidation range between $2.22 and $2.23.

As traders assess the current landscape, XRP sits at a tactical pivot point following this dramatic washout. Moving forward, careful monitoring of key support and resistance levels will be essential for navigating the potential recovery or further declines.