The cryptocurrency XRP, currently trading at $2.25 as of November 17, 2025, presents a compelling case for traders looking for actionable insights. Despite ongoing consolidation, technical indicators suggest a potential upswing within the next 4 to 6 weeks, with forecasts indicating a price target between $2.70 and $3.15.

The short-term outlook for XRP anticipates a modest increase, with expectations of reaching $2.42 to $2.50, reflecting a gain of 7 to 11 percent. In the medium term, analysts are eyeing a range of $2.70 to $3.15, which translates to a potential rise of 20 to 40 percent. For bullish momentum to persist, XRP must breach the immediate resistance level of $2.66. Conversely, should the price dip below $2.07, a bearish scenario could unfold, with further declines possible.

Analysis from November 14, 2025, reveals a consensus among major analysts regarding XRP“s price trajectory. While some platforms like Changelly and CoinCodex predict more conservative targets of $2.23 and $2.28, respectively, the majority cluster around the $2.70 mark. Notably, platforms such as Blockchain.News and Benzinga suggest moderate bullish views, while Cryptopolitan and WEEX Crypto Wiki set more aggressive targets at $3.60 and $3.15, respectively, citing favorable technical setups and regulatory developments.

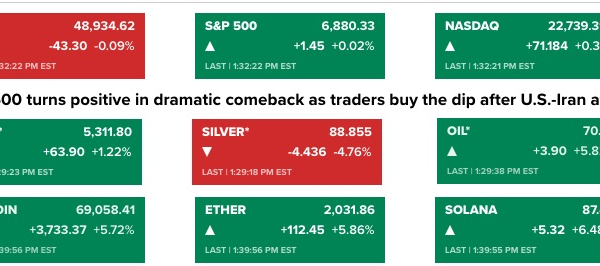

Current technical analysis indicates that XRP is trading below its key moving averages, positioned 36.49 percent off its 52-week high of $3.55. However, indicators such as the Relative Strength Index (RSI) at 42.60 show neutral momentum, suggesting that while the price may have room to decline, there are opportunities for accumulation. The Moving Average Convergence Divergence (MACD) histogram has a value of -0.0045, pointing toward bearish momentum, but a potential convergence between the MACD and its signal line could occur soon.

The Bollinger Bands analysis indicates that XRP is closer to the lower band at $2.13 compared to the upper band at $2.59, implying a possible mean reversion towards the middle band at $2.36. With a 24-hour trading volume of $284.25 million on Binance, there is sufficient liquidity for breakout attempts, although increased volume will be necessary to validate any bullish momentum.

Looking at both bullish and bearish scenarios, the primary target for XRP lies between $2.70 and $2.85, a zone where several analyst predictions converge. A confirmed breakout above $2.66 could result in significant technical buying, propelling XRP towards the $2.70 range in about 2 to 3 weeks. Should it surpass $2.85, the next target would be $3.10 to $3.15, contingent upon sustained daily trading volumes exceeding 400 million and an RSI above 60.

However, the immediate risk is pronounced if XRP falls below $2.07, which would invalidate the current consolidation pattern and could lead to a downturn towards $1.80. The strong support level at $1.25 serves as a critical downside target if broader market conditions worsen.

For those considering entry points, a layered approach is advisable. Initial accumulation should occur between $2.20 and $2.25, representing a 25 percent position size. Additional purchases at $2.07 and $1.90 can facilitate dollar-cost averaging should market conditions shift adversely. Conservative traders might set stop-loss orders below $1.80, while more aggressive strategies could employ a stop at $2.00.

Profit-taking strategies should include scaling out at $2.50 for an 11 percent gain, $2.70 for a 20 percent increase, and $3.15 for a 40 percent profit, aligning with various probability scenarios.

In conclusion, XRP is positioned for potential growth towards the $2.70 to $3.15 range in the coming weeks, bolstered by technical indicators despite present consolidation. Traders should remain vigilant for key confirmation signals, such as an RSI above 50 and positive MACD movement, to validate the bullish outlook. Conversely, sustaining trades below $2.07 would undermine this positive sentiment, necessitating a reassessment of lower support levels.