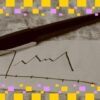

In a recent analysis, crypto expert Steph has identified a noteworthy chart that could indicate an upcoming surge in the price of XRP. He believes the altcoin is potentially forming a bottom, setting the stage for its next upward movement.

Steph shared insights via an X post, emphasizing the importance of the 3-week XRP price chart. He noted that the Stochastic Relative Strength Index (RSI) has plummeted to 0.00 on this timeframe, a phenomenon that is exceedingly rare and has only occurred once before, during the 2022 bear market bottom.

According to Steph, such a significant drop in the RSI suggests that selling pressure has been completely exhausted, which bodes well for XRP“s price trajectory. He cautioned, however, that this does not guarantee an immediate price reversal. The last time this indicator emerged, XRP entered an extended accumulation phase before making a substantial upward move.

Steph”s analysis points to the notion that downside risk for XRP is structurally limited, with long-term holders absorbing supply instead of selling off their positions. He further remarked that these signals generally signify cycle lows, rather than short-term trading opportunities.

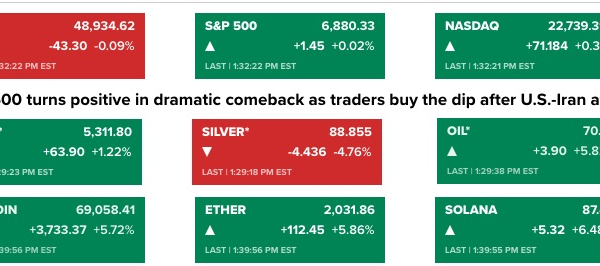

Additionally, XRP exchange-traded funds (ETFs) present a positive outlook, as these funds have maintained a consistent inflow streak. Since the launch of the Canary”s fund on November 13, these ETFs have recorded daily inflows, accumulating net assets exceeding $1.1 billion, despite significant ongoing demand from institutional investors.

In another analysis shared on X, CryptoXLarge pointed out that on the weekly chart, the XRP price remains below a descending trendline situated between the 8 to 21 Exponential Moving Averages (EMA). This week, XRP is attempting to stay above a crucial support level around $1.95, which coincides with the Fibonacci 0.5 level and the 89-week EMA, a support that has proven resilient throughout the year.

CryptoXLarge indicated that a weekly close beneath this critical level could elevate the chances of a decline towards the $1.60 support level, represented by the Fibonacci 0.618. Conversely, if XRP closes above $1.95, it may spark increased buying interest, potentially leading to a relief rally towards $2.30 and subsequently $2.70.

Crypto analyst Crypto King echoed similar sentiments, suggesting that a reclaim of $1.98 could enable XRP to reach as high as $3.66. As of the latest data from CoinMarketCap, XRP is trading at approximately $1.87, reflecting a positive change over the last 24 hours.

In conclusion, the current technical indicators and ETF inflows suggest potential bullish momentum for XRP, but traders should remain cautious of the key support and resistance levels that will dictate the short-term price action.