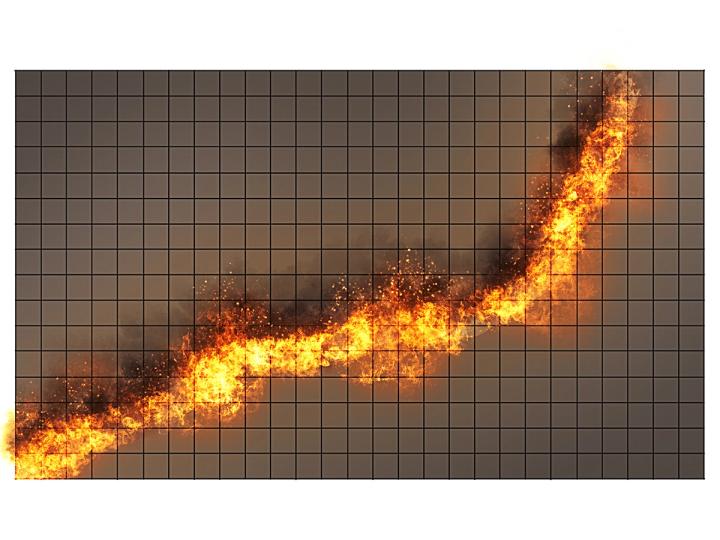

XRP saw a decline of 5% recently, following a noteworthy mention from CNBC, which labeled it the “hottest trade” of 2026, outshining established cryptocurrencies like Bitcoin and Ethereum. This shift in attention raises questions about market dynamics and investor sentiment moving forward.

Despite the recent price drop, institutional interest in XRP remains robust, particularly through U.S.-listed spot XRP exchange-traded funds (ETFs). Early January has continued to witness notable net inflows into these investment vehicles, reflecting sustained demand from institutional investors. This trend suggests that while price fluctuations are common, the underlying interest in XRP as an asset class is not diminishing.

The current market reaction indicates a complex interplay of factors affecting XRP“s performance. As institutional players increasingly look toward XRP for exposure, its status could evolve, potentially influencing trading strategies across the board. The investment landscape is shifting, and the spotlight on XRP could reshape its role within the broader cryptocurrency market.

In the context of regulatory developments and market acceptance, XRP could either solidify its position or face challenges ahead. Investors and analysts alike will be closely monitoring these dynamics, especially as the year unfolds and more data on ETF performances and institutional strategies become available.