In a notable market shift, XRP has fallen to $1.44, marking its lowest point since the November 2024 U.S. presidential election. This decline has broken through a significant support level, raising alarms about further price drops and investor confidence.

According to CoinDesk, the breach of the $1.44 support indicates a shift in market dynamics, with control moving from buyers to sellers. The situation has led to questions regarding XRP“s short-term stability and overall market sentiment in the altcoin sector.

The recent price action for XRP highlights a clear technical breakdown. Previously, the $1.44 level had acted as a solid floor during a significant sell-off in April 2025, drawing substantial buying interest. The failure to maintain this support level signals bearish trends that market analysts are closely observing. Current data shows a concerning lack of support between $1.44 and the psychologically relevant $1.00 mark, suggesting that sustained selling pressure could lead to a rapid decline.

This downward trend unfolds within a complex macroeconomic and regulatory environment. The cryptocurrency market is often sensitive to broader financial indicators, interest rate expectations, and the clarity—or ambiguity—of regulations. Initially, the post-2024 election period introduced volatility, which has now transitioned into a phase of consolidation that XRP appears to have breached.

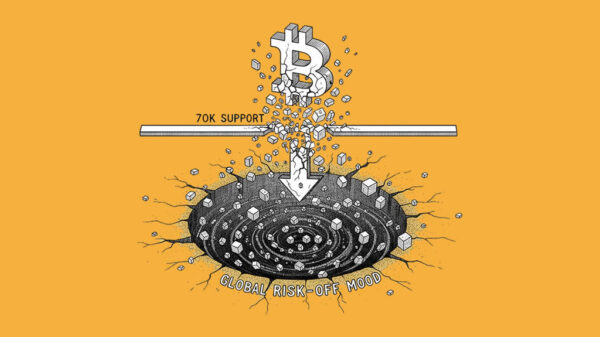

The performance of XRP cannot be isolated from the overall digital asset market, which has seen increased volatility in early 2025. While Bitcoin and Ethereum face their own challenges, altcoins like XRP often experience exaggerated price movements. The breaking of a long-standing support level for a major token like XRP can have cascading effects, potentially intensifying selling pressure on other large-cap altcoins.

To illustrate the gravity of this decline, a comparative performance table indicates that XRP has underperformed significantly:

- Asset: XRP | Key Support (2025): $1.44 | Current Status: Breached | Year-to-Date Change: -22%

- Asset: Bitcoin (BTC) | Key Support (2025): $58,000 | Current Status: Testing | Year-to-Date Change: -8%

- Asset: Ethereum (ETH) | Key Support (2025): $3,100 | Current Status: Holding | Year-to-Date Change: -12%

This data reflects XRP“s relative vulnerability compared to market leaders, suggesting specific challenges or diminishing investor interest.

Market analysts emphasize the significance of trading volume during such breakdowns. A high-volume decline, as noted in this instance, suggests stronger seller conviction compared to a low-volume slip. A seasoned chart analyst remarked, “The breach of the $1.44 support on significant volume is a classic technical failure.” This situation transforms the previously supportive price point into a new resistance level, impacting future price movements.

Beyond technical considerations, fundamental factors remain critical. The ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) continues to loom large. While key legal decisions have been made, their implications for institutional engagement with XRP remain uncertain. Any adverse regulatory news can swiftly sway investor sentiment.

The immediate outlook for XRP hinges on market reactions in subsequent sessions. Several scenarios could unfold:

- Rapid Reclamation: A swift recovery above $1.44 could indicate a false breakdown, potentially triggering a short-covering rally.

- Consolidation Zone: Prices might fluctuate within a range of $1.20 to $1.44 as the market seeks a new equilibrium.

- Continued Descent: Trading consistently below $1.44 could pave the way to $1.20, possibly testing the critical $1.00 psychological level.

Risk management is crucial in this climate. Traders typically reassess their positions and stop-loss orders after a significant technical break. The lack of strong historical support down to $1.00 means buying interest must emerge organically, which can be volatile. Long-term investors may view this as a potential accumulation phase, but history suggests that such bottoms are often revisited before a sustained recovery occurs.

The recent drop in XRP to its lowest level since the 2024 election signifies a pivotal moment for the cryptocurrency. The breach of the critical $1.44 support represents a notable technical shift favoring sellers. While the broader digital asset market faces numerous challenges, XRP“s pronounced weakness necessitates careful monitoring by market participants. The future trajectory will depend on the ability of buyers to defend lower levels or if momentum drives the token toward a significant test of the $1.00 threshold.

As a reminder, the volatility of cryptocurrency markets underscores the importance of rigorous technical and fundamental analysis.