XRP is currently attracting significant market interest as it stabilizes above crucial technical levels, supported by approximately $250 million in first-day inflows from the newly launched U.S. spot XRP ETF. Despite the ongoing volatility across the cryptocurrency landscape, the chart structure and liquidity profile of XRP suggest that it might be approaching a pivotal pre-breakout phase.

At present, XRP is trading around $2.31, navigating through a period of moderate selling pressure. Daily chart data from FenzoFx indicates a tightening consolidation range between $2.072 and $2.223, a zone where XRP has historically attracted buying interest. The asset is currently priced at $2.309, showing mild selling pressure while consolidating between these key levels.

Accumulation phases often emerge when sellers lose momentum and long-term holders begin to absorb supply. Historical patterns for XRP, seen in cycles from April 2021 and July 2023, demonstrate that multi-week accumulation phases can precede strong directional movements, as volatility compresses and liquidity consolidates at higher time-frame support levels. The current market structure exhibits similar traits, including reduced range expansion, stable funding sentiment, and increased spot volume compared to futures trading.

While XRP remains within a sideways channel, this pattern can frequently act as a foundation for volatility expansion. However, it is important to note that consolidation does not guarantee an upward breakout, especially amid unstable macroeconomic conditions.

On the liquidity front, data from Bloomberg ETF analyst Eric Balchunas reveals that Canary Capital“s spot XRP ETF recorded around $250 million in launch-day inflows. This marks one of the most successful crypto ETF debuts of 2025, highlighting early institutional interest in gaining exposure through regulated investment vehicles rather than direct token custody. Notably, XRP surpassed this year”s ETF launches with $58 million in Day One trading volume, closely followed by $BSOL with $57 million.

The ETF”s in-kind swap mechanism enables liquidity providers to exchange XRP for ETF shares without relying exclusively on open-market purchases. This approach helps mitigate slippage during substantial allocations and can momentarily stabilize order books during inflow periods. However, it is crucial to recognize that this structural feature does not automatically drive XRP”s price upward; inflows can reverse, demand may fluctuate with overall market sentiment, and ETFs do not shield investors from the inherent volatility present in crypto markets.

In terms of short-term price outlook and key levels, analysis suggests that immediate resistance for XRP is located at $2.456, while major support is found between $2.072 and $2.223, with an additional secondary support area around $1.922. A successful move towards the $2.456 resistance will necessitate a clear rise in trading volume and broader market stabilization. Conversely, failing to exceed this level could prompt another examination of the previously mentioned support zones.

Historical context for the fourth quarter indicates that XRP has achieved an average return of approximately 134% over the last 12 years during this period. While this seasonal trend is noteworthy, it is essential to remember that past performance does not guarantee future outcomes, especially given the current macroeconomic uncertainties and volatility driven by Bitcoin.

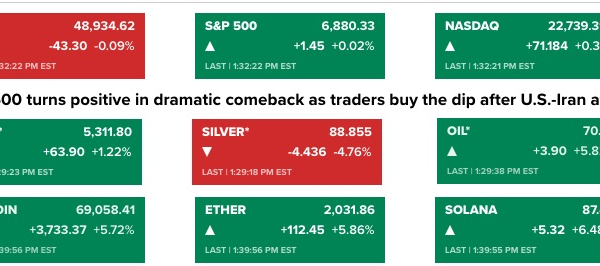

The broader market dynamics continue to influence short-term price movements. Recent declines in Bitcoin below $100,000 have heightened risk-off sentiment within the crypto sector. Correlation data from Kaiko highlights that XRP remains closely linked to Bitcoin during macro-driven sell-offs. The support for XRP against USDT currently stands at $2.24 amidst a downtrend, with resistance levels at $2.315–$2.4465 and support from $2.153–$2.097; a decline below $2.153 might trigger further downward movement.

Looking at regulatory developments, the approval of a U.S.-listed XRP ETF carries implications for international markets still developing their frameworks for digital assets. For instance, under Pakistan”s provisional Virtual Assets Ordinance 2025 (PVARA), local investors remain unable to directly access U.S. crypto ETFs, and the regulatory framework is pending final parliamentary approval.

In conclusion, XRP is navigating a critical consolidation phase, bolstered by strong ETF debut inflows and a well-defined technical base. With resistance at $2.456 and key support levels between $2.072 and $2.223, while historical performance and ETF-driven attention provide cautious optimism, substantial risks from broader market volatility and shifting liquidity conditions persist. XRP was trading at approximately $2.25, reflecting a 0.74% increase in the last 24 hours at the time of reporting.

Investors are advised to interpret technical patterns as probabilistic tools rather than certainties, continuously monitoring macro trends and ecosystem developments to grasp XRP”s evolving market path.