In a notable development within the cryptocurrency landscape, Winslow Strong, the former head of Qualia Research, has executed a significant transfer of digital assets amounting to $32.6 million. This transaction, highlighted by on-chain analytics, reveals that an address associated with Strong withdrew over $32 million in CBBTC and Ethereum from the Aave platform and subsequently deposited these funds into Coinbase.

This substantial deposit has captured the attention of the crypto community, prompting discussions regarding the implications for market sentiment and the strategies employed by prominent figures in the space.

Analyzing the $32.6 Million Transaction

The movement of assets, as identified by Lookonchain, is particularly significant. It involved the withdrawal of 307 CBBTC (equivalent to approximately $27.03 million) and 1,900 ETH (valued around $5.6 million). Such a large transfer from a decentralized finance (DeFi) protocol like Aave to a centralized exchange (CEX) such as Coinbase is typically indicative of a strategic shift. Analysts often interpret this kind of action as a precursor to potential asset liquidation or a repositioning for increased liquidity.

Understanding the Impact of Such Transfers

To fully appreciate the ramifications of this transaction, it is essential to dissect its components. Initially, the assets were sourced from Aave, a prominent lending and borrowing protocol where Strong likely benefitted from yield generation on his holdings. The decision to transfer these assets to Coinbase, a platform that facilitates trading and fiat conversions, suggests a pivot in strategy. Key aspects of the transfer include:

- Asset Composition: The assets involved are primarily Bitcoin (in the form of CBBTC) and Ethereum.

- Timing: This transaction occurred merely eight hours prior to reporting, marking it as a fresh event in market dynamics.

- Scale: The $32.6 million transfer is sufficiently large to impact short-term market liquidity and perceptions.

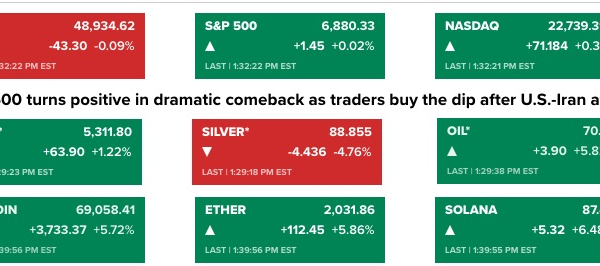

Market Reactions to Major Deposits

Transactions executed by influential entities, often referred to as “whales,” serve as critical indicators within the crypto market. The actions of a seasoned researcher like Winslow Strong prompt heightened scrutiny. This particular deposit may signify various strategic intentions, including profit-taking, a transition to fiat, or simply a portfolio reallocation. Notably, this action also removes liquidity from the DeFi ecosystem, potentially impacting lending and borrowing activities.

Key Takeaways for Crypto Enthusiasts

While it is crucial not to react impulsively to any single transaction, this event can enhance personal market analysis. Here are some actionable insights:

- Monitor Exchange Flows: Significant inflows to exchanges can often indicate impending selling pressure, whereas outflows to private wallets may suggest accumulation.

- Context Matters: Assess broader market conditions to determine if this is part of a wider trend among whales shifting to exchanges.

- Research the Actor: Familiarity with Winslow Strong”s historical trading patterns might offer additional context, although past performance is not indicative of future results.

In conclusion, Winslow Strong”s deposit of $32.6 million into Coinbase serves as a stark reminder of the intricate and transparent nature of blockchain markets. It illustrates the strategic maneuvers of major holders and emphasizes the importance of staying informed through dependable on-chain data. Investors should always maintain a long-term strategy that is resilient to the fluctuations caused by individual transactions.

Frequently Asked Questions (FAQs)

Who is Winslow Strong? Winslow Strong is recognized as the former head of Qualia Research, a firm specializing in cryptocurrency analysis and investment.

What is CBBTC? CBBTC is a wrapped Bitcoin token that allows Bitcoin to be utilized across different blockchains, including in DeFi protocols like Aave.

Why transfer from Aave to Coinbase? Moving funds from a DeFi platform like Aave to a centralized exchange like Coinbase typically enhances accessibility for trading and fiat conversion, signaling a potential change in strategy.

Is Winslow Strong selling his crypto? A deposit to an exchange facilitates selling but does not confirm that a sale has taken place. It may indicate preparations for trading, securing assets, or utilizing other services offered by Coinbase.

How can I track similar transactions? Platforms such as Lookonchain, Nansen, and Etherscan enable users to monitor significant wallet movements and identify trends among notable investors.

Should I be concerned about this large deposit? One transaction should not dictate your investment decisions. It represents a single data point that should be evaluated within the larger context of market developments and your financial objectives.

Share this analysis on social media to help others stay informed about significant movements in the cryptocurrency market.

For further insights into current cryptocurrency trends, consider exploring our articles on pivotal developments affecting Bitcoin and Ethereum”s price trajectories and the ongoing trend of institutional adoption.