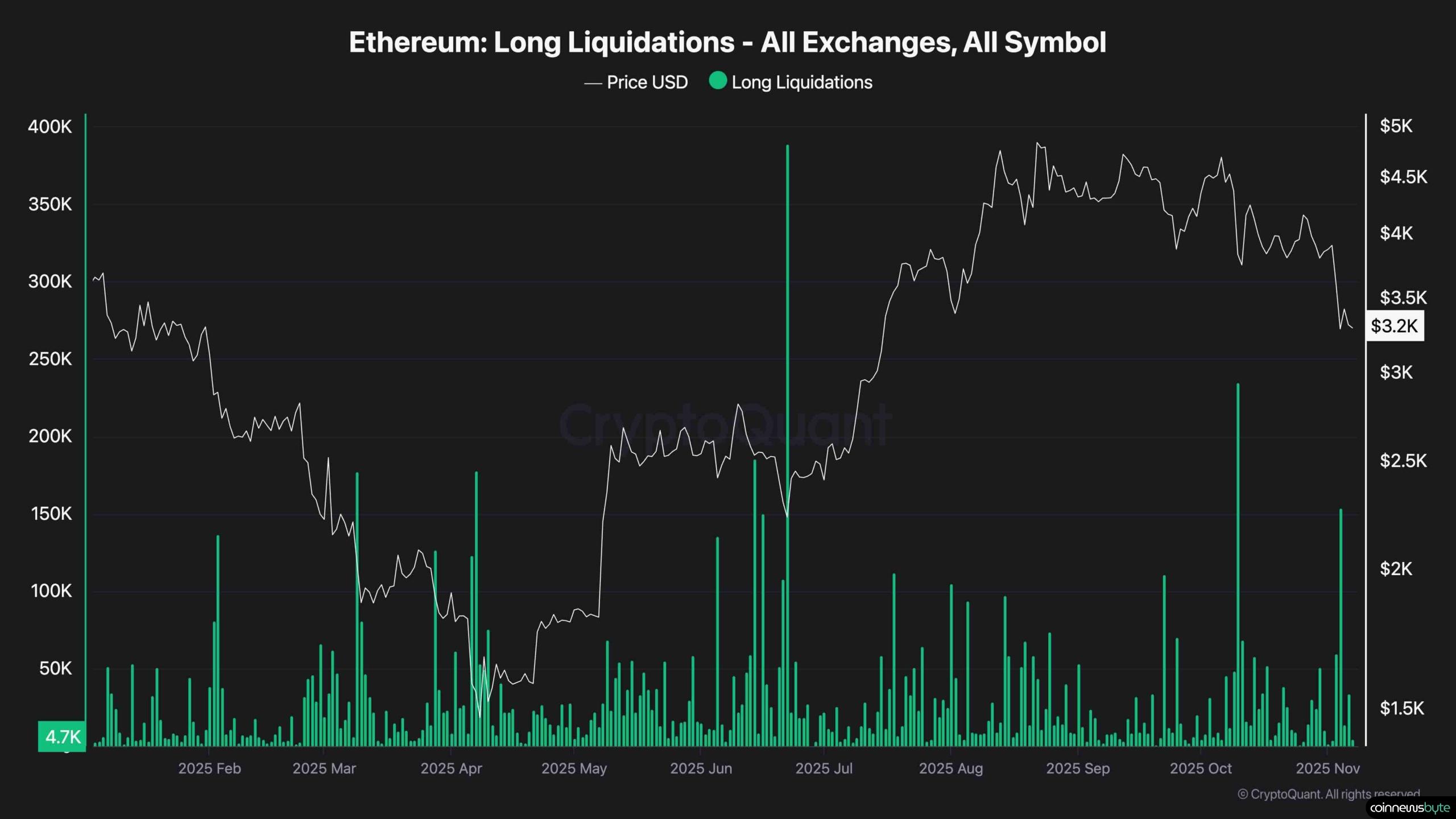

The price of Ethereum has recently fallen below the $3,300 threshold, signaling ongoing selling pressure in this price zone. Although bearish momentum has not yet reached a significant level, the drop follows a substantial liquidation event that has already eliminated many over-leveraged long positions. This scenario increases the likelihood of further declines, suggesting that spot sellers could be establishing control, potentially leading to a deeper short-term correction.

Examining the daily chart reveals that ETH has breached its trading channel and has dipped slightly below the 200-day moving average. Currently, it is also breaking through the critical $3,300 demand zone. Losing this key level is significant, as the 200-day moving average is often regarded as a vital indicator for determining whether the market is in a bullish or bearish phase. The Relative Strength Index (RSI) remains weak at 32, indicating that the market is not positioned for recovery at this time.

For buyers to reclaim control, ETH needs to stage a breakout above $3,500 and convert that level, along with the 200-day moving average, into support. Until such a move occurs, the price remains in a precarious position that could drive it toward the $3,000 support level in the near future.

On the four-hour chart, there is evident rejection from the lower boundary of the broken channel and the previous support zone around $3,400. Currently, ETH is hovering near this level without forming a convincing rebound or establishing a higher low. The RSI is stabilizing below the 50% mark, reinforcing the bearish momentum. As ETH continues to dip below $3,300, the likelihood of a rapid descent towards the $3,000 zone and potentially lower increases.

From a sentiment perspective, the recent liquidations have wiped out a significant number of late long entries, creating a clearer environment for price stabilization. The chart indicates a notable spike in liquidations just prior to a minor bounce, confirming a market shakeout. With many positions cleared, and the RSI approaching oversold territory across various timeframes, a market reset may soon be on the horizon. However, traders are likely to remain cautious, awaiting more definitive signs of strength and a break back above $3,500 before re-entering long positions.

Conversely, a decline towards the $3,000 mark could trigger another wave of liquidations, potentially leading to a more significant liquidation event and resulting in a flash crash within the upcoming weeks.