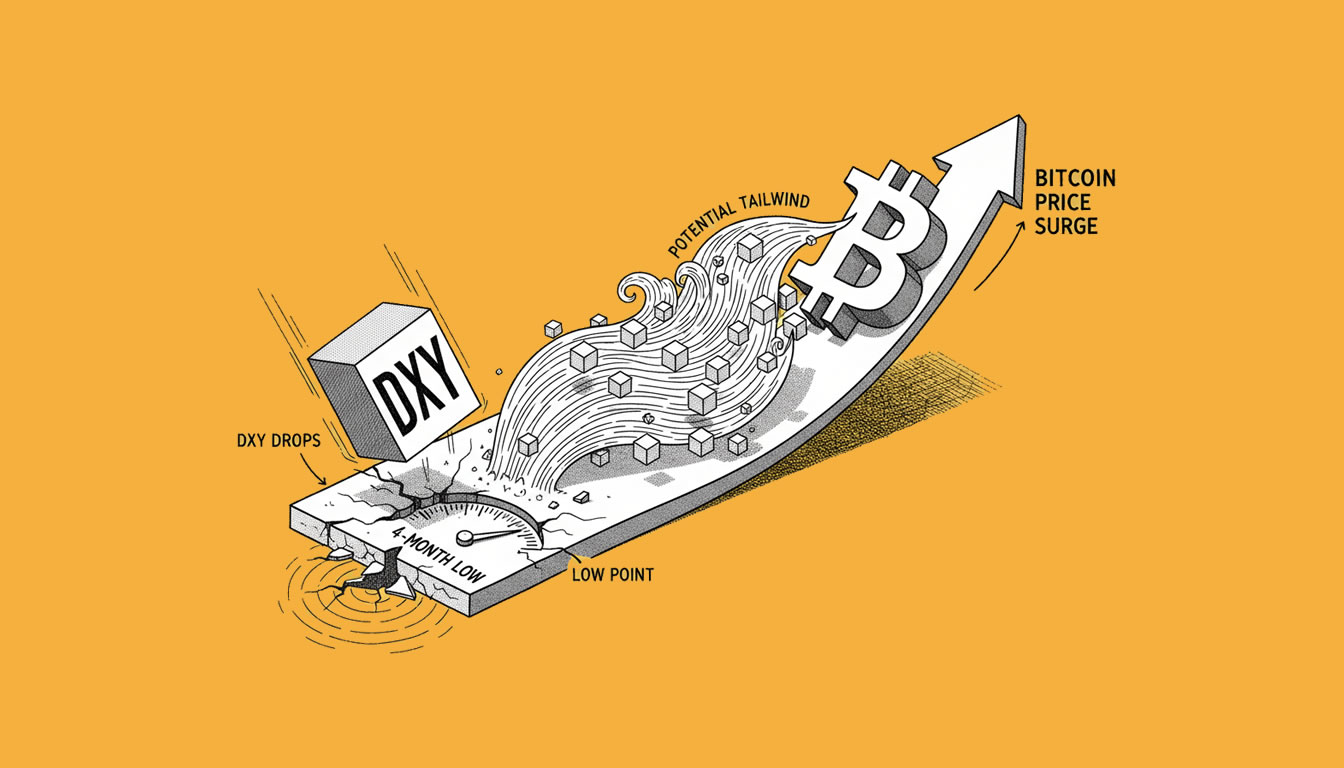

The US Dollar Index (DXY) has recently fallen to its lowest point in four months, hovering near the 97 mark. Such a decline in the dollar often serves as a catalyst for Bitcoin and other risk assets, historically indicating a favorable environment for cryptocurrencies.

As of January 26, 2026, the DXY”s drop signals growing market expectations that the Federal Reserve may soon adopt a more dovish monetary policy. This shift is notable as the index has breached key technical levels, which typically prompts capital to flow into alternatives like Bitcoin, viewed as a hedge against inflation.

However, the current response from Bitcoin has been less than enthusiastic. Trading at approximately $87,000, BTC finds itself under pressure due to significant outflows from exchange-traded products (ETPs), which saw net withdrawals of $1.7 billion last week. This marks the largest such outflow since November 2025, reflecting a persistent risk-averse sentiment in the market.

In contrast, traditional safe-haven assets such as gold have demonstrated remarkable strength, recently surpassing the $5,000 threshold. This trend suggests that investors are currently favoring established hard assets over digital currencies amidst ongoing macroeconomic and geopolitical uncertainties.

While the technical breakdown of the DXY could provide a long-term tailwind for Bitcoin, immediate price movements remain constrained by derivative positioning and broader market sentiment. Traders are closely monitoring upcoming policy updates from the Federal Reserve for clearer direction.

Additionally, major altcoins like Ethereum are exhibiting a similar cautious trading pattern, reflecting the overall sentiment in the cryptocurrency market.

This article is intended for informational purposes and does not constitute financial advice. Readers are encouraged to conduct their own research before making investment decisions.

The potential implications of the DXY”s performance on Bitcoin and the broader cryptocurrency landscape remain crucial topics for market participants as they navigate these evolving conditions.