The cryptocurrency market showcased notable activity on November 6, 2025, highlighted by the remarkable performance of SOON, which surged by an impressive 111.36%. This surge has positioned SOON as the standout coin of the day, drawing significant attention from traders and investors.

Overall, the total cryptocurrency market capitalization experienced a slight increase, rising from $3.44 trillion to $3.45 trillion, marking a 0.25% change within the last 24 hours. Meanwhile, the total trading volume across all cryptocurrencies also saw a modest uptick of 0.25%, reaching approximately $510.84 billion.

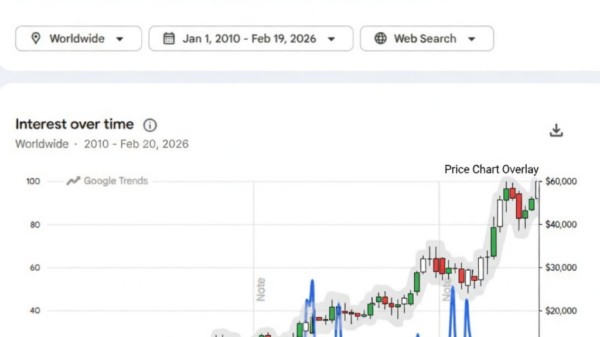

At the heart of the market, Bitcoin (BTC) is currently trading at $103,126, reflecting a gain of 1.28% over the past day. Bitcoin”s market dominance has also seen an increase, now accounting for 59.69% of the total cryptocurrency market, up by 0.65%.

In the broader landscape of major cryptocurrencies, Ethereum (ETH) holds the position as the second-largest cryptocurrency, valued at $3,388.97 with a market capitalization of $409.04 billion. Ethereum has also experienced a positive movement, gaining 1.82% in the last 24 hours. For those looking to assess future price trajectories, detailed forecasts for Bitcoin and Ethereum can be found on their respective prediction pages.

Despite the gains seen by SOON and a few other coins, the overall market sentiment appears bearish, with 62% of the top 200 cryptocurrencies experiencing declines in value over the past day. Following SOON, the next largest gainers include Mina Protocol and DigiByte, showcasing gains of 27.45% and a lesser extent, respectively.

However, not all coins fared well in this trading session. Jelly-My-Jelly emerged as the worst performer, suffering a decline of 21.27%, while Dash followed closely with a drop of 14.36%. Other notable underperformers included Story, Mantle, and FTX Token, which rounded out the list of significant losses.

In summary, with SOON”s remarkable rise, the cryptocurrency market continues to exhibit volatility, presenting both opportunities and challenges for investors. Keep an eye on market movements as they unfold, and consider the overall trends as you navigate the ever-evolving landscape of digital assets.