Solana is currently facing downward pressure, trading at approximately $77.97, which represents a drop of over 2% within the past 24 hours. This recent decline follows a gradual descent from the range of $100 to $120, positioning the price just above a significant support zone between $75 and $80.

On higher timeframes, the technical structure indicates a loss of momentum for SOL, particularly after repeated failures to maintain levels near $140. Notably, the weekly chart illustrates $77 as a historically reactive level, with deeper support extending to around $67 and $56 if selling pressure continues.

As SOL retests its long-term descending bullish trendline, traders are closely monitoring this critical zone. Each significant contact with this trendline over the past two years has been associated with substantial price reversals. Currently, SOL hovers between $77 and $80, just above the key support band of $75 to $82. A solid hold at this level is essential to maintain the structural integrity. Conversely, a drop below $75 could lead to a deeper liquidity pocket around $67 to $70, where prior demand clusters have formed.

In a broader analysis, the Elliott wave structure indicates a potential recovery scenario. Recent charts suggest that the price is nearing completion of a corrective phase, having retraced to the 1.236–1.618 Fibonacci extension zone, maintaining its position above the psychological $75 to $80 region. If SOL stabilizes above this level, it could initiate an upward movement, with $101 serving as the first confirmation threshold. A reclaiming of $119 would signify greater strength, paving the way towards targets of $175 to $180, followed by significant resistance near $253 to $265. Until the price can reclaim $101, the current situation remains a recovery attempt rather than a confirmed breakout.

Despite the short-term price weakness, the underlying fundamentals for Solana are strengthening. According to SolanaFloor, the blockchain has achieved approximately 959 million weekly transactions, marking a new all-time high. Meanwhile, on-chain data from DeFiLlama indicates that total value locked (TVL) in SOL is climbing back towards cycle highs, suggesting continued engagement within its ecosystem.

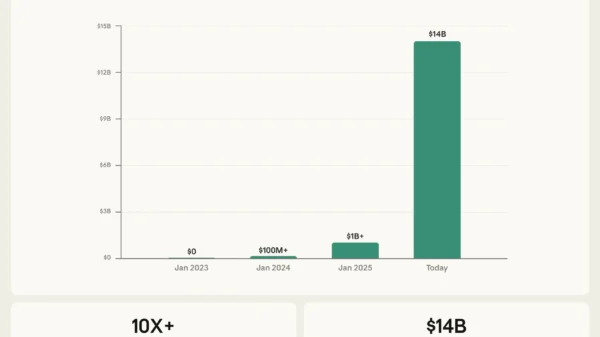

The institutional narrative is also evolving, as recent reports reveal increased exposure to Solana-linked products among major financial players. Historically, periods characterized by accelerated on-chain growth during price retractions often create favorable environments for medium-term recovery.

Analyzing market sentiment, it appears that SOL is currently trading in a heavy sentiment zone following its recent decline to lower support. This kind of pressure is typically observed at structural decision points rather than at market peaks. Technically, the price is reacting at a major higher-timeframe support region around $75 to $80. As long as this area remains intact, there is potential for a rebound towards the $100 to $120 range.

Looking at the broader landscape, the $140 level is pivotal. It previously served as macro support before shifting to resistance. Regaining this level could restore medium-term momentum for bulls, while beyond that, $175 and $211 would represent the next structural hurdles before potentially moving towards $250 to $295. However, should SOL fail to maintain the $75 to $77 zone, downside liquidity pockets are positioned near $67 and $56. At present, Solana”s price is consolidating at a historically reactive support level while on-chain metrics continue to hit new highs, indicating that the next move will hinge on Bitcoin”s stability and general market sentiment over the upcoming weeks.