The beginning of 2026 has been tumultuous for silver, with prices experiencing dramatic fluctuations. Following a remarkable rise to approximately $121 on January 29, the metal witnessed a staggering decline of nearly 47% by February 6. However, a notable recovery ensued, propelling silver to around $84 by February 20. With markets closed on February 21 and 22, the crucial question facing investors as March approaches is whether this recovery can be sustained or if further downturns are imminent.

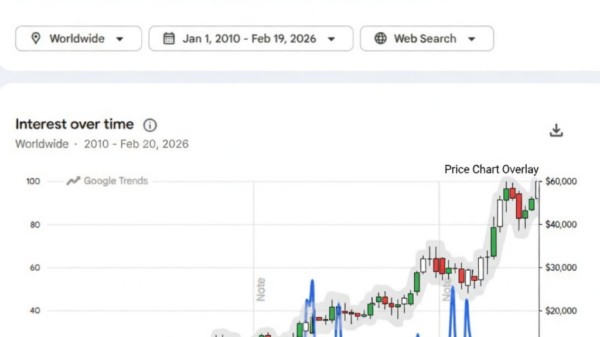

The daily chart for XAG/USD indicates a developing cup pattern, characterized by an initial impulse wave starting from November 21, 2025, peaking at $121 before retracing to $63.85 on February 6. The recent uptick towards $84 approaches the neckline of this technical formation. Between February 4 and February 20, silver has formed a lower high setup, while the relative strength index (RSI) during the same time has printed a higher high, demonstrating a hidden bearish divergence. This suggests that, despite apparent strength in the RSI, a consolidation phase may be necessary before any significant price movement.

Notably, smart money appears to be anticipating this consolidation. A significant whale, identified as “0xaCB,” has deposited $5 million in USDC into HyperLiquid, increasing positions in GOLD and establishing new short positions in SILVER. As of February 21, 2026, the whale”s positions included nearly 3,000 ounces of gold and over 97,000 ounces of silver.

The strength of mining operations further adds to the bullish narrative surrounding silver. The Global X Silver Miners ETF (SIL), currently trading above $107, has shown resilience following its peak at $119 on January 26, occurring just before silver spot prices hit their all-time high. This leading behavior of miners suggests a robust fundamental picture remains intact, even after January”s sharp sell-off.

However, a divergence exists between the physical and futures markets. COMEX silver futures are trading near $82, which is below the current spot price of $84, highlighting a backwardation scenario. This situation indicates that buyers are currently willing to pay a premium for physical silver, reflecting urgency in demand. Despite this, open interest in silver futures has been declining since February 6, even as the price has risen from $63 to $82. This pattern suggests that the rally may be driven by short covering rather than new investments.

The macroeconomic environment also plays a crucial role in silver”s trajectory. The US Dollar Index (DXY) is above 97 and has seen a steady rise since February 11. Interestingly, silver began to increase alongside the dollar from February 17, signaling a notable underlying demand. This behavior is significant, as it indicates that buyers are prioritizing silver regardless of dollar strength.

Nevertheless, caution is warranted due to the gold-silver ratio, which is currently at 60 and consolidating within a bullish flag pattern. Any breakout above the upper trendline could shift market attention back to gold, capping silver”s upward momentum. Furthermore, the latest Commitment of Traders (COT) report indicates that hedge funds maintain a relatively low net long position, suggesting that institutional investors are waiting for a more stable base before committing additional capital.

As March unfolds, the outlook for silver appears balanced. Key indicators reveal a bullish leaning, including the strength of mining stocks, evidence of physical demand, and a divergence from the dollar. Conversely, declining open interest and the potential for a shift in the gold-silver ratio present risks that must be monitored closely. The most likely scenario is that silver will consolidate within a range of $75 to $92, establishing a foundation for future movement. A daily close above $84 would confirm the cup-and-handle pattern, while a push past $91–$92 could open the door to a more substantial rally.

On the downside, a close below $75 could invalidate the bullish structure, potentially leading to a retest of $71 and exposing further support levels. The overall sentiment suggests that while silver may face challenges, the groundwork is being laid for a potential resurgence in prices as market dynamics evolve.