Significant price fluctuations in raw materials such as crude oil, gold, and copper are increasingly capturing the attention of investors and businesses alike. These shifts are primarily influenced by supply disruptions, changes in demand, and broader macroeconomic factors. In recent years, heightened volatility has characterized commodity prices, with crude oil exhibiting movements of 5-10% in short durations, largely due to geopolitical tensions and energy transition dynamics.

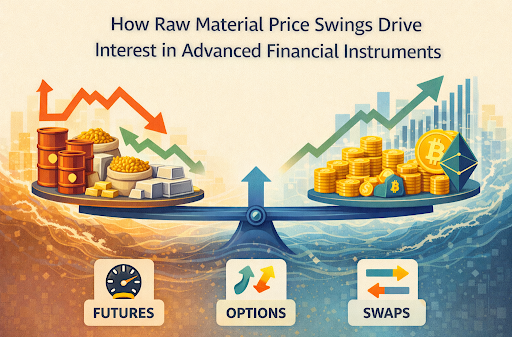

This unpredictability not only introduces risks but also opens up opportunities, compelling market participants to explore advanced financial instruments for hedging and speculation. Platforms that offer commodity derivatives have emerged as vital tools for navigating these unpredictable swings in the market. This article delves into how price volatility in raw materials fuels the demand for derivatives such as CFDs and futures contracts.

Understanding the Drivers of Price Volatility

The primary drivers behind the volatility in raw material prices are imbalances in supply and demand. For instance, decisions made by the OPEC+ alliance regarding production can significantly affect crude oil prices, swinging them by 10-15%. Additionally, adverse weather events can disrupt agricultural outputs, while strikes within the mining sector can impact metals like copper, which is crucial for electrification.

Further amplifying these price movements are macroeconomic factors. When inflation rates exceed targeted levels, gold often sees increased demand as a hedge. Conversely, interest rate hikes can strengthen the dollar, putting pressure on commodities priced in USD. Notably, currency weaknesses in emerging markets tend to spur local buying, further elevating demand.

Geopolitical risks also contribute significantly to volatility. Conflicts or trade disputes in key regions, such as the Middle East for oil or South America for copper, can lead to sharp price increases. Each of these dynamics creates a climate of uncertainty, which in turn drives further volatility.

How Volatility Fuels Interest in Derivatives

Given the impracticalities of direct ownership of commodities—due to factors like storage costs, spoilage risks for agricultural products, and delivery logistics—derivatives provide a valuable alternative. These financial instruments allow investors to gain exposure to commodity price movements without the need for physical ownership.

In particular, futures contracts and CFDs empower hedging strategies. Producers can lock in prices to safeguard their profit margins, while consumers can secure costs in advance. For example, a mining company might short copper futures against its inventory to mitigate potential losses from price drops.

Speculators are also keen to capitalize on volatility. Leverage options in CFDs can transform a 5% movement in crude oil prices into a potential 50% gain at 10x leverage. Perpetual contracts with funding rates facilitate around-the-clock trading, enabling market participants to react promptly to global news.

Institutional adoption of these derivatives is on the rise, with hedge funds increasingly utilizing them for portfolio balancing. Recently, reports indicated hedge funds hold approximately $50 billion in commodity-linked assets, reflecting the dual nature of volatility as both a risk and a potential reward.

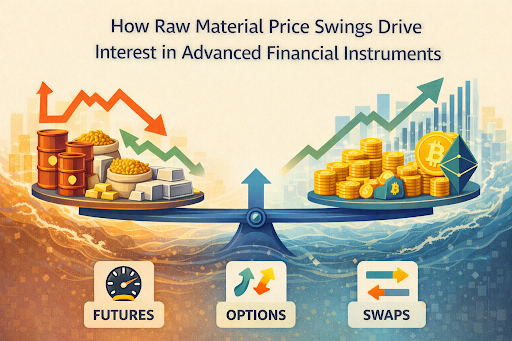

Key Derivative Instruments for Raw Materials

Several key derivative instruments are prominent in the raw materials space:

- Futures Contracts: These standardized agreements for future delivery are traded on exchanges and are primarily used to hedge physical positions, although they require margin and involve rollovers.

- CFDs: These contracts mirror price movements without granting ownership, settling in cash. They offer leverage up to 20x and lack an expiry date, making them suitable for active traders.

- Options: These provide the right to buy or sell at predetermined strike prices, capping downside risk while preserving upside potential. While premiums are incurred, volatility can enhance their value.

While volatility presents opportunities, it also poses significant risks. Leverage can amplify losses considerably; for instance, a 5% decline at 20x leverage can wipe out capital. Additionally, during market crashes, liquidations may occur, reflecting the harsh reality that approximately 80% of retail traders incur losses.

Transaction fees can further erode potential profits, with spreads and funding rates compounding costs. An effective strategy to mitigate risks includes copy trading, which allows investors to mirror professional traders who maintain high win rates on commodity news. Opting for traders with low drawdown percentages—ideally under 10%—can enhance safety.

In summary, price fluctuations in raw materials driven by various factors are propelling interest in advanced derivatives such as CFDs and futures contracts. These instruments facilitate hedging, speculation, and leverage without physical ownership, transforming volatility into opportunities. Investors are advised to utilize leverage judiciously, risk a small percentage of their capital, and diversify their instruments. In today”s uncertain markets, derivatives have become essential tools for navigating the complexities of commodity trading.