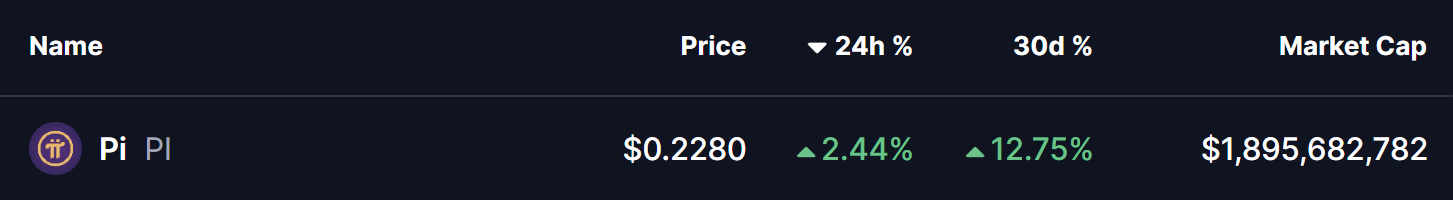

Pi Network (PI) has exhibited notable resilience in a turbulent altcoin market, gaining 12% over the past month, even as Ethereum (ETH) has faced a decline of more than 17%, now trading around $3,200. This performance is particularly striking given the broader market”s volatility.

One of the most significant developments for PI is the emergence of a clear harmonic pattern, specifically a Bearish Bat pattern, on the 4-hour chart. This pattern is crucial for identifying potential reversal zones, particularly as the final leg, known as Point D, is nearing completion.

The formation began at Point X, which is marked at $0.2857, followed by a sharp decline to Point A, a recovery to Point B, and a second corrective leg, reaching Point C at approximately $0.2101. Since then, PI has demonstrated a steady recovery and is currently trading near $0.2282, indicating the initial signs of bullish momentum.

Adding to the bullish outlook, PI has successfully reclaimed its 100-hour moving average, currently positioned around $0.2277. This level has now become a critical support zone for investors who are betting on PI”s upward trajectory.

Looking ahead, maintaining a position above the 100-hour moving average could signal a shift in market sentiment, potentially setting the stage for higher price targets. If the Bearish Bat pattern continues to unfold as expected, PI may aim for the Potential Reversal Zone (PRZ) between $0.2761 (0.886 Fibonacci level) and $0.2857 (1.0 Fibonacci level). This target range represents a potential upside of roughly 25% from the current trading price and aligns with traditional harmonic completion standards.

However, it is essential to remain cautious. Should PI fail to hold the support level at $0.22, the bullish structure may weaken, possibly leading to another short-term pullback before any future upward attempts.

In summary, while the broader market faces challenges, the technical indicators for Pi Network suggest that there is potential for a significant upside move, contingent upon the continuation of favorable price action.

Disclaimer: The analysis provided in this article is for informational purposes only and reflects the author”s views. It does not constitute financial advice. Market conditions can change rapidly, and investors should conduct independent research and consult their financial advisors.