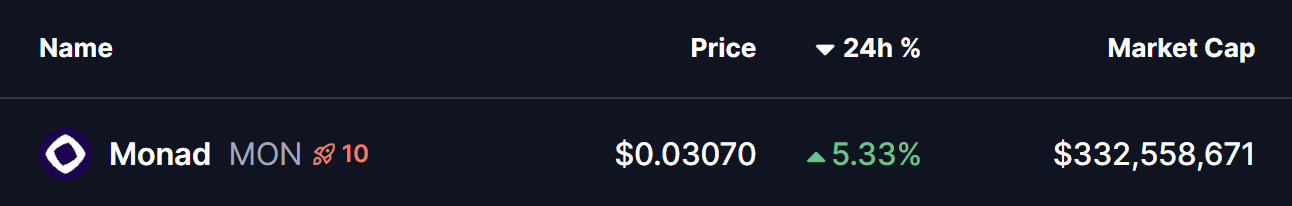

The cryptocurrency market is currently experiencing a surge, with Ethereum (ETH) gaining over 4% in the past 24 hours. This positive momentum has also boosted several altcoins, including Monad (MON), which is up nearly 5% today. However, despite this short-term uplift, MON”s lower-time-frame technical indicators are raising concerns about potential downside risks.

On the 2-hour chart, MON appears to be developing a possible Double Top pattern, a well-known bearish reversal signal that often signifies a loss of upward momentum following a rapid price increase. Recently, the price faced resistance around $0.03314, coinciding with the 200-period moving average, which acted as a strong barrier. This rejection formed the second peak of the Double Top, prompting a pullback to the current trading level of approximately $0.03067.

The emergence of selling pressure at this critical resistance level is one of the first indications that buyers might be losing their grip on the market. If the Double Top pattern continues to unfold, MON could potentially test its neckline support around $0.028. This level has previously proven to be a robust demand zone. Nevertheless, a decisive decline below this point would confirm a breakdown of the pattern.

A breakdown from this support could lead to further declines, targeting the $0.02280 area, which would represent a significant drop of about 25% from current values, aligning with the typical outcome of a fully realized Double Top structure. However, the bears are not fully in control yet. If MON can reclaim the 200 MA near $0.03310 and establish a strong close above it, this bearish scenario could be neutralized, allowing the bulls to regain momentum.

Currently, MON finds itself at a pivotal juncture. While the technical structure indicates early signs of weakness, the bulls still hold a chance to reclaim dominance if they can defend key support levels in the sessions ahead.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author”s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.