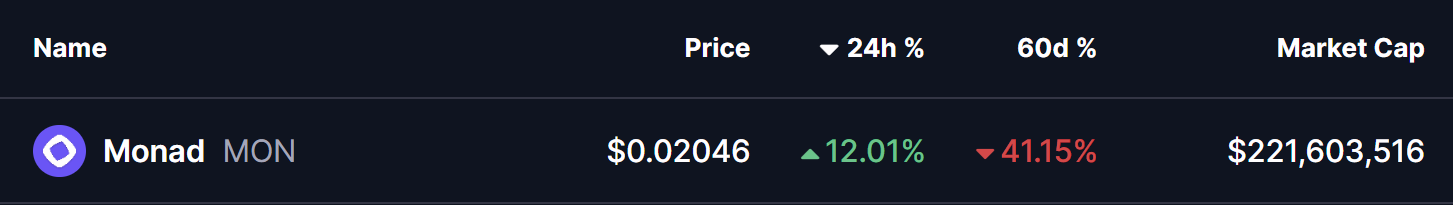

Monad (MON), the native token of the Monad Layer-1 blockchain, has faced significant challenges recently, experiencing a decline of approximately 41% over the past two months. This downturn has been primarily attributed to a slowdown in total value locked (TVL) growth and a reduction in revenue generated by applications within its ecosystem. However, signs of a shift in sentiment are beginning to emerge.

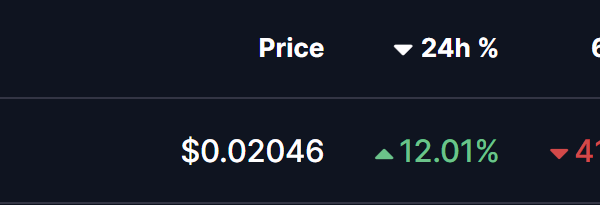

MON has recently bounced back by 12%, and its daily price chart indicates the formation of a potential bullish reversal pattern, suggesting that the downward momentum may be weakening. The critical support level appears to be around $0.018, where buyers have consistently stepped in to defend against further declines.

On the daily time frame, the price action suggests the development of a double bottom pattern. This classic bullish reversal structure typically arises at the conclusion of prolonged downtrends. The first bottom was established when the token fell towards the $0.018 support area, followed by a rebound that momentarily approached the neckline resistance near $0.02970. However, this recovery was met with resistance, and MON retested the same support level.

In this recent price action, buyer behavior has been noteworthy. Demand has re-emerged around the $0.018 level, preventing a breakdown and confirming the formation of the second bottom in the structure. Currently, MON is trading near $0.02071, indicating that selling pressure may be diminishing. Additionally, momentum indicators like the MACD are hinting at a potential bullish crossover, which is often viewed as an early indication that the downside momentum is subsiding and that buyers may be ready to re-enter the market.

For this bullish scenario to gain traction, MON must reclaim the 50-day moving average, currently situated around $0.02266. A sustained move above this threshold would signal a shift in short-term momentum and enhance the likelihood of a recovery rally. If buyers successfully push the price towards the $0.02970 neckline, market participants will be closely monitoring developments. A decisive breakout above this resistance level, ideally followed by a successful retest, would validate the double bottom pattern and pave the way for a more robust upward movement.

Conversely, the $0.018 support zone remains a vital level that must be defended. A breakdown below this area would invalidate the bullish setup, likely leading to another wave of declines or prolonged consolidation.

In conclusion, despite the recent challenges, MON”s technical structure is beginning to exhibit constructive characteristics. The repeated defense of the same lows, the emergence of a double bottom pattern, and improving momentum signals suggest that Monad may be on the verge of a turning point. If key support continues to hold and the token can reclaim its short-term moving averages, MON might be preparing for a recovery phase, especially if overall market conditions stabilize in the upcoming days.

Disclaimer: The information provided in this article is for informational purposes only and reflects the author”s perspective. It should not be construed as financial advice. The technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are encouraged to conduct their own research and make decisions based on their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, bringing over five years of expertise in the cryptocurrency and blockchain industry. Since establishing Coinsprobe in 2023, he has delivered daily, research-driven insights through detailed market analysis, on-chain data, and technical research.