Recent analysis from the crypto sentiment platform Santiment indicates that memecoins might be on the cusp of a resurgence, despite a prevailing atmosphere of market pessimism. Over recent months, these tokens have been largely overlooked, but signs suggest that this negativity could be setting the stage for renewed interest.

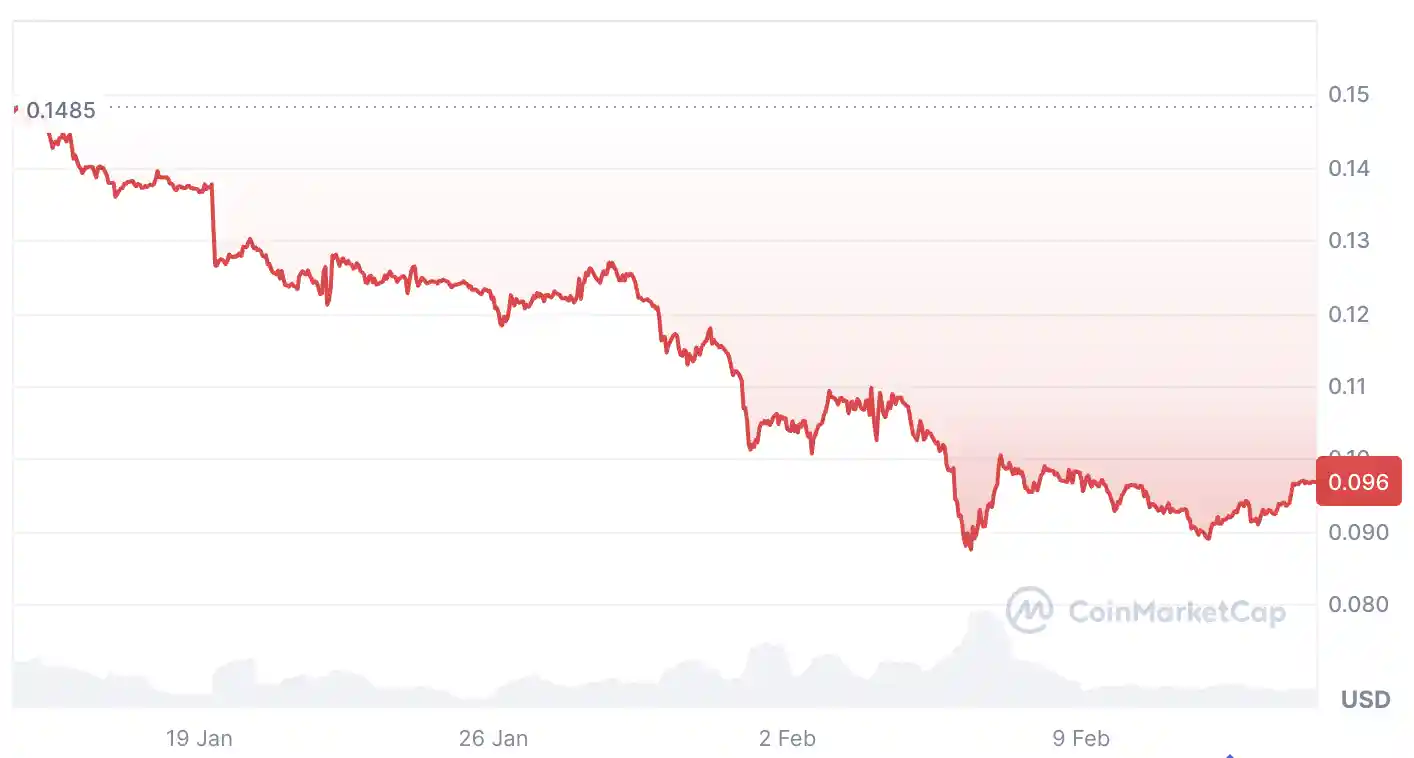

As the broader cryptocurrency market continues to face challenges, historical trends reveal that periods of intense pessimism often serve as a precursor to potential recoveries. Memecoins, often characterized by their speculative nature, have seen Dogecoin (DOGE) experience a significant drop of 32% within the last month. This decline has contributed to a narrative among traders that the “meme era” has come to an end—a sentiment that Santiment describes as a classic capitulation signal.

Capitulation occurs when investors collectively decide to write off an investment sector, often indicating that the worst has passed and a turnaround may be imminent. This historical behavior suggests that contrarian investors might find opportunities in neglected assets at this stage. Indeed, the total market capitalization of memecoins has fallen by 34.04% to $31.02 billion during this turbulent period.

Despite the overall market downturn, some memecoins have defied the trend. For instance, Pippin (PIPPIN) experienced a notable surge of 243.17% in the past week, while Official Trump (TRUMP) and Shiba Inu (SHIB) recorded minor gains of 1.37% and 1.11%, respectively. This divergence highlights the potential for select memecoins to attract investor interest even as the broader market struggles.

Market analysts are revisiting traditional patterns of altcoin rotation. Historically, a rally in Bitcoin has typically led to capital flowing into Ethereum (ETH) and subsequently into riskier altcoins. However, some experts speculate that the current market conditions may alter this dynamic, suggesting a need for more selective investment strategies rather than broad assumptions about market growth.

Additionally, social media sentiment surrounding memecoins remains heavily bearish, which may actually indicate a potential rebound on the horizon. Santiment emphasizes that when market sentiment is overwhelmingly negative, it can lay the groundwork for future price recoveries. Traders are advised to keep a close watch on the evolving landscape of memecoins, particularly in relation to social media trends and historical capitulation patterns, which can signal pivotal market shifts.

In summary, while the memecoin sector is currently experiencing significant challenges, the combination of low sentiment and historical patterns suggests that there may be an opportunity for a turnaround. Investors should remain vigilant, monitoring social sentiment and market movements closely for emerging opportunities.