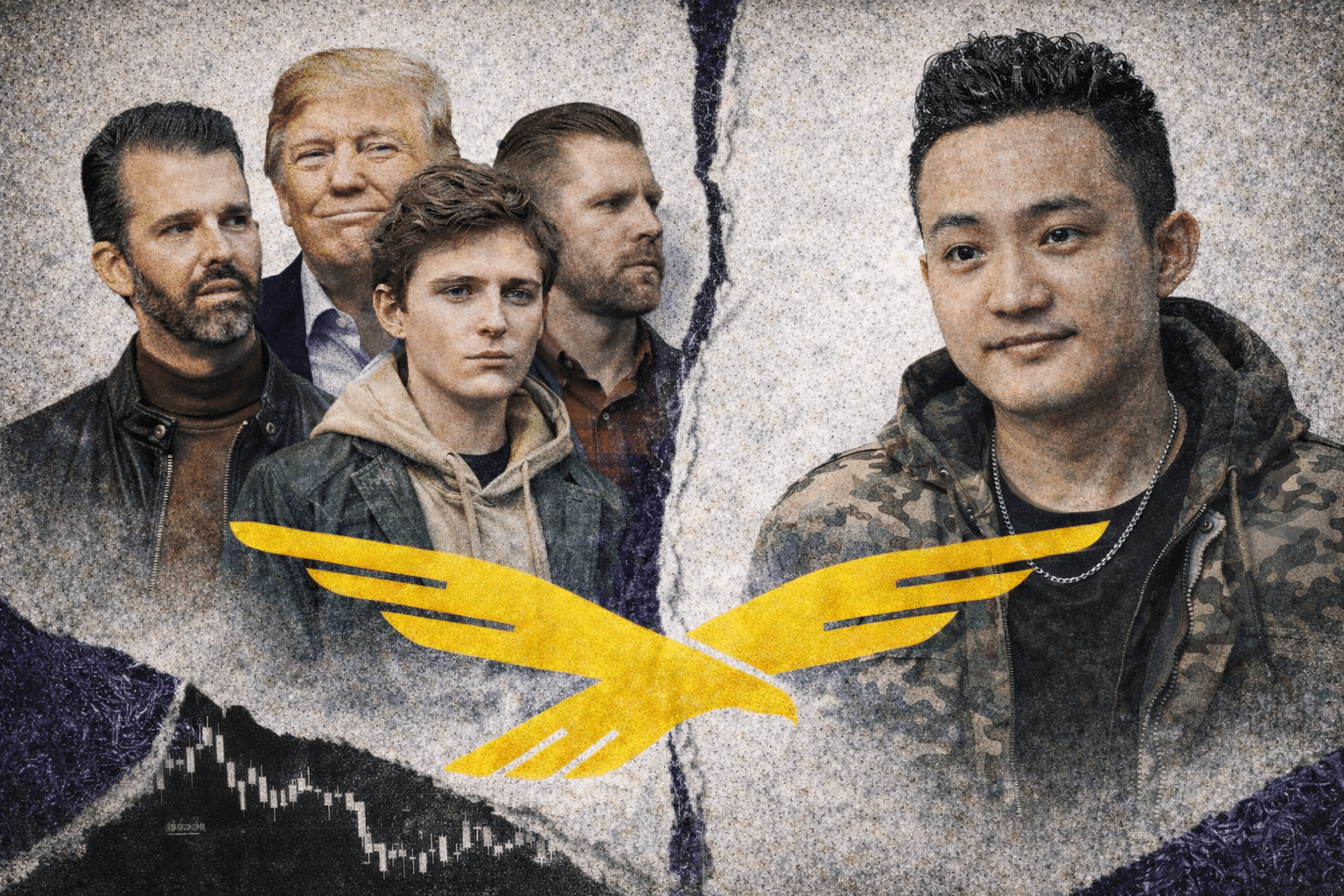

In a significant development, Justin Sun“s locked World Liberty Financial (WLFI) tokens have experienced a staggering decline of approximately $60 million in paper value since September. This downturn comes as his wallets remain blacklisted by the project, according to on-chain analytics provided by Bubblemaps.

In early September, World Liberty Financial took the drastic step of blacklisting 272 wallets due to concerns over security and misconduct. Among these flagged addresses, analysts have linked one specifically to Sun. This blacklist effectively freezes Sun”s ability to move his WLFI holdings, despite his assertions that he has not engaged in any misappropriation and has called the freeze unreasonable.

Sun made a substantial investment totaling $75 million in WLFI tokens through TRON DAO, initiating his involvement with an initial purchase of $30 million in late 2024. Following the launch, the value of his holdings soared to over $700 million, marking a notable rise before the recent decline.

Such events underscore the volatility and risks inherent in the cryptocurrency space, where regulatory actions and project governance decisions can lead to significant market impacts. Investors and industry participants are left to navigate an environment where asset values can shift dramatically based on administrative measures.