Cardano has recently regained attention in the cryptocurrency market, with analysts suggesting that the digital asset could be approaching its bottom. Currently trading near multi-month lows, ADA has experienced a decline of 3% in the last 24 hours, extending its year-to-date correction to 21%. Despite bearish trends dominating the market, many enthusiasts remain optimistic.

Notable crypto analyst and YouTuber Crypto Jebb, whose real name is Jeeb McAfee, characterized ADA as “a great asset.” He pointed out the cryptocurrency”s significant potential as it trades at what he describes as favorable price levels. His insights highlight that upcoming developments within the Cardano ecosystem, including the launch of the Midnight mainnet and the Leios Ouroboros upgrade, could play a pivotal role in its future performance.

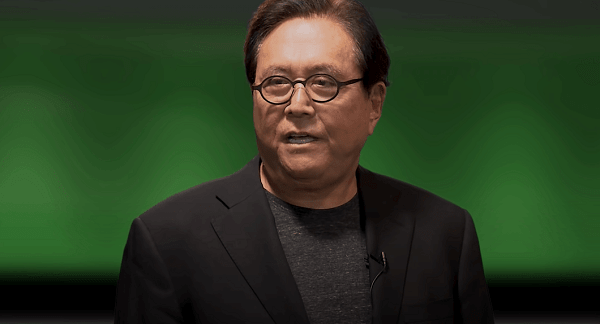

One of the key attributes that sets Cardano apart is its fixed supply of 45 billion tokens, a characteristic shared with only a few major cryptocurrencies like Bitcoin and XRP. This unique feature contributes to its appeal as a blue-chip asset, especially at current price levels. Referencing the famous quote by Charlie Munger, vice chairman of Berkshire Hathaway, Jebb noted that “buy great assets at good prices” may very well apply to the current situation with Cardano.

Moving beyond fundamental analysis, Jebb also indicates that momentum indicators suggest Cardano may be nearing a bottom. He referenced the alignment of the Relative Strength Index (RSI) with historical price bases on higher timeframes. Historically, when ADA”s RSI falls into oversold territory—specifically around 30—it has marked significant turning points. Currently, the RSI stands at 28.03, which is close to these historically critical levels.

Jebb emphasized that such conditions have previously presented excellent investment opportunities in Cardano. If ADA can maintain its current support level, he anticipates a substantial rebound. His projections indicate potential targets of between $1.50 and $2 over the next 12 to 24 months. A rise to $1.50 would reflect an 8.52x risk-to-reward ratio, equating to a 337% increase, whereas a climb to $2 would signify a 466% increase, representing an 11.8x risk-to-reward ratio.

Nevertheless, it is crucial to note that broader market conditions remain unpredictable, and volatility may affect the timing of any recovery. For the moment, the combination of Cardano”s low prices, historical signals, and promising ecosystem developments positions it as a cryptocurrency worth monitoring closely.