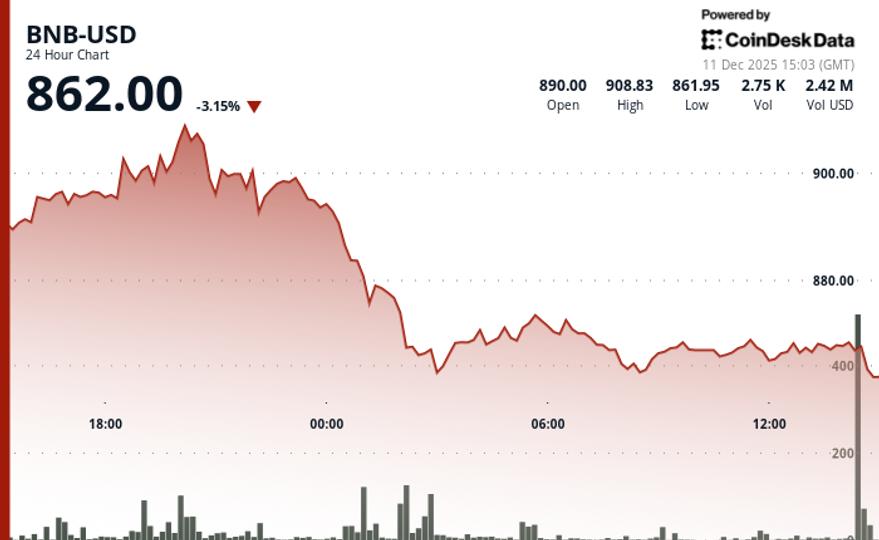

The price of BNB, the native token of the BNB Chain, has experienced a 3% decline in the past 24 hours, settling at $865. This drop comes as traders assess the implications of the Federal Reserve”s rate cut announced on Wednesday. During the same period, the broader CoinDesk 20 (CD20) index fell by 3.4%.

Previously, BNB had reached a peak of $908.83 on Wednesday before undergoing a significant reversal. The decline intensified as the token broke through the $870 support level, a critical threshold that had been stable in recent weeks. According to technical analysis data from CoinDesk Research, this breakdown was accompanied by increased trading volume.

Additionally, BNB has slipped below both its 30-day moving average and the 23.6% Fibonacci retracement level, which stands at $874. These indicators typically signal to traders that a short-term uptrend may be nearing its end.

While BNB found temporary support around $861.95, several attempts to bounce back toward $870 faced resistance. Currently, the token is fluctuating within a narrow range, with buyers attempting to defend the $864–$867 area and sellers limiting any gains at approximately $868.50.

At this juncture, traders are exhibiting a cautious stance. A recovery past $874 could shift the momentum favorably; however, with network activity scheduled to halt, many market participants are holding off on making new positions until the upgrade is finalized. Should the downward trend continue, BNB could test the next support level at $839, identified through Fibonacci analysis.

Parts of this article were generated with the assistance of AI tools and have been reviewed by our editorial team to ensure accuracy and adherence to our standards. For further details, refer to CoinDesk”s comprehensive AI Policy.