Bitcoin experienced a significant surge, climbing past $94,000, which led to a wave of liquidations totaling approximately $300 million across the cryptocurrency market. This sharp upward movement caused a dramatic reshuffling of positions among traders, with significant implications for major digital assets.

In just 24 hours, over 107,000 traders faced liquidations, amounting to $387.5 million in forced exits. Notably, a single liquidation event involved a long position on Bitcoin worth nearly $24 million on the HTX exchange. Despite the robust macroeconomic backdrop, Ripple”s token, XRP, remained relatively subdued, trailing behind its peers during this market rally.

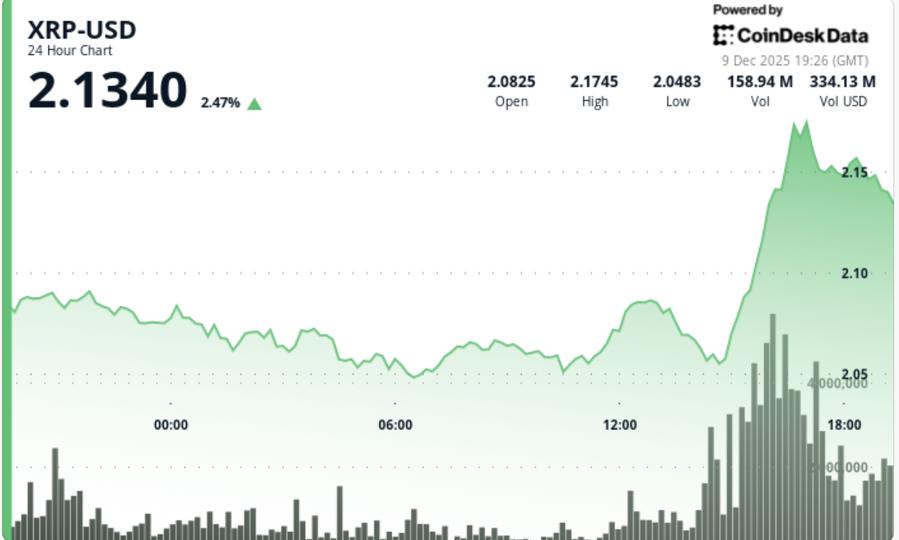

The performance of XRP raised eyebrows, as it underperformed the CD5 index by 1.55%, suggesting a rotation away from XRP amidst the broader market surge. Furthermore, institutional trading volumes did not see a significant uptick, with 24-hour trading volume falling 5.88% below its seven-day average, even in light of the positive price movement.

This disparity between a strong macro rally and XRP”s lackluster performance points to potential challenges ahead. Technically, XRP shows an intraday structure that is constructive, marked by higher highs and higher lows. Still, momentum remains inconsistent when juxtaposed with other major cryptocurrencies.

Support for XRP has solidified around $2.05, where it has seen multiple successful tests. The recent rally toward $2.17 established a new local resistance level. However, the lack of sustained volume growth raises questions about the strength of this upward move. Indicators on lower timeframes suggest a softening momentum following the breakout attempt, with a notable volume rejection at resistance levels around $2.15 to $2.16.

This behavior indicates profit-taking rather than a complete trend reversal. Nonetheless, it confirms that without increased participation, bullish control remains tenuous. As Bitcoin pulls other major assets upward, XRP”s relative underperformance serves as a technical indicator, hinting at either a delayed catch-up or a deeper consolidation phase should the macro momentum start to wane.