The currency pair AUD/USD experienced a slight decline on Wednesday following the announcement of Australia”s latest wage inflation statistics. The reported figures indicated a moderate rise in wages in the fourth quarter, with private sector growth showing a minor improvement. However, annual wage growth has remained relatively stable, showing no significant changes for over a year.

According to data released by the Australian Bureau of Statistics, the wage price index increased by 0.8% in the December quarter, aligning with both the previous quarter”s performance and market expectations. Annual wage growth saw a modest uptick to 3.4% from 3.3%, maintaining a consistent range of 3.2% to 3.6% for six consecutive quarters.

Looking forward, market participants are keenly anticipating several critical economic reports from the United States, which will include durable goods orders and industrial production figures, as well as the minutes from the upcoming Federal Open Market Committee (FOMC) meeting.

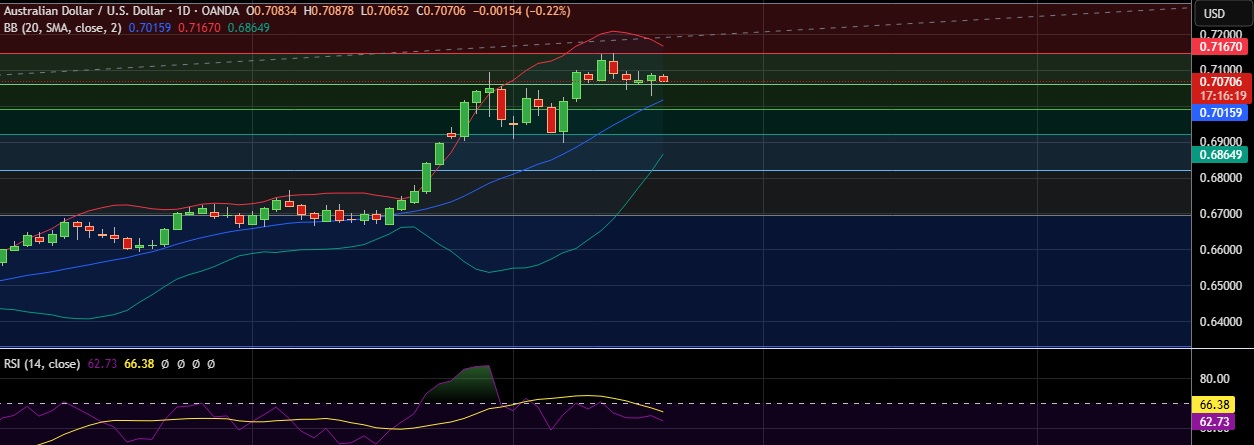

In terms of technical analysis, immediate resistance for AUD/USD is identified at 0.7144, corresponding to the 23.6% Fibonacci retracement level. A sustained close above this level could propel the pair towards 0.7169, which aligns with the upper Bollinger Band. Conversely, support is noted at 0.7060, the 38.2% Fibonacci level, and a break below this could see the pair drop to 0.7019, which is the 20-period simple moving average.

Given the current market dynamics, a recommendation is to consider buying around the 0.7040 mark, with a stop loss set at 0.6980 and a target price of 0.7100.