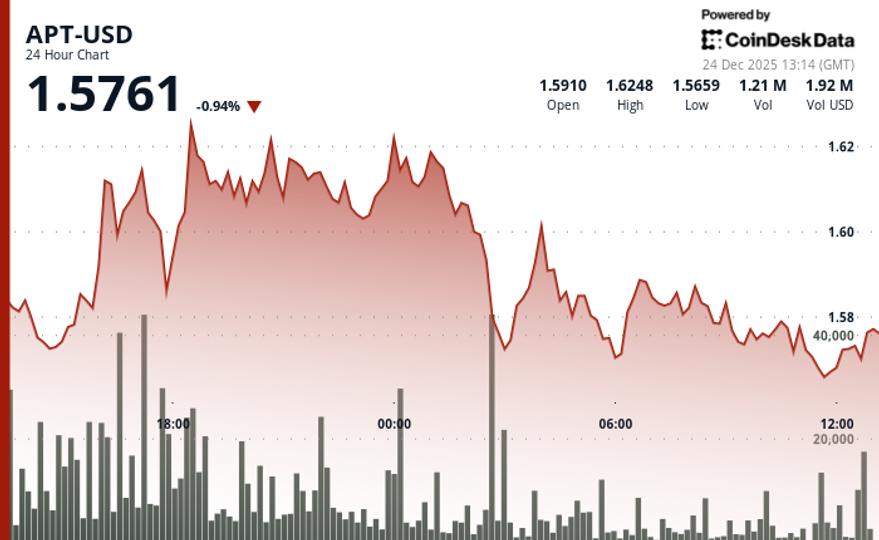

The APT token from Aptos has experienced a decline of 1%, settling at $1.56 as it mirrors the downturn in the overall cryptocurrency market. This retreat comes as the CoinDesk 20 index also noted a decrease of 0.6% at the time of reporting.

During the past 24 hours, APT traded within a narrow range of $1.62 to $1.56, establishing a volatility span of $0.06, which corresponds to an intraday volatility rate of 3.6%. According to technical analysis conducted by CoinDesk, there is a notable struggle between bullish and bearish forces around the $1.63 resistance level during the evening trading hours.

Support for APT has remained robust near the $1.56 mark, even as trading activity slowed during the holiday period. Trading volume surged by 71% above the average for the past 24 hours, reaching 4.69 million tokens, which coincided with a spike in selling pressure following a brief peak at $1.62.

A technical assessment reveals that APT completed a double-bottom formation at the $1.52 support level prior to breaching the $1.56 resistance. Primary resistance continues to hold at $1.66, having faced multiple tests. Meanwhile, support has solidified around $1.56.

The recent 11% decline in trading volume compared to the 30-day average suggests a potential fatigue among traders. However, isolated spikes above 46,000 tokens indicate ongoing accumulation interest among select market participants. The formation of a double-bottom structure at the $1.52 support level has prompted a rally attempt, potentially setting the stage for upward movements above the $1.56 resistance.

Should APT achieve an upside breakout, immediate targets lie in the $1.58 to $1.585 resistance cluster. Conversely, a breakdown below the $1.56 support could pave the way for a retest of the $1.52 level.

As the crypto landscape continues to evolve, market participants are advised to stay vigilant regarding the technical indicators surrounding APT and broader market dynamics.

Disclaimer: Portions of this article were generated with assistance from AI tools and have been reviewed by our editorial team to ensure accuracy and compliance with our standards. For further information, refer to CoinDesk“s complete AI Policy.